If 2018 was a year in which all asset classes fell, 2019 was the exact opposite, with all of them delivering a positive return. The difference? US central bank policy, as the Federal Reserve (Fed) pivoted from its tightening policy of 2018 to easing interest rates three times over 2019. This, combined with continued easy monetary policy from other major central banks including the European Central Bank, Bank of Japan and Bank of England, ensured that financial conditions improved throughout the year and supported asset prices in all markets.

While this was not enough to reverse the global economic slowdown that began in early 2018, it sowed the seeds of a rebound in growth which only now is starting to show through in the data.

Geopolitics played an important role in 2019. Trade wars between the US and China, Brexit uncertainty, Hong Kong protests and European populism contributed to an economic slowdown and generally downbeat sentiment among corporate leaders. However, record low levels of unemployment in many developed economies, plus healthy real wage growth, meant that the consumer kept on spending. Despite the slowdown in growth, the threat of recession was always remote.

Equities were the star performer of the year, led once again by the US market, which rose over 32%. Emerging markets were the laggard, held back by their greater exposure to trade disruptions. Fixed income also enjoyed strong returns as bond yields fell over the year. UK, European and US government bonds delivered over 6% for 2019, while investment grade and high yield markets enjoyed returns in excess of 10% in local currency terms.

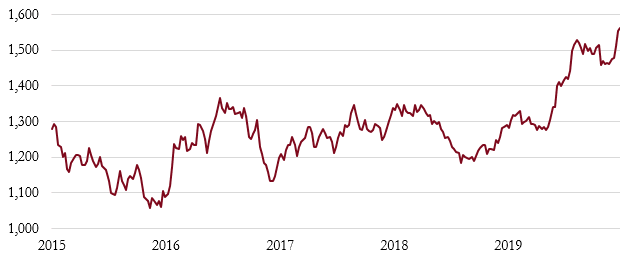

Gold was another asset that moved sharply higher in 2019. The drop in bond yields and heightened geopolitical tensions pushed the price above $1,500 and up 18% over the year.

Zeitgeist: the long-term context

Since 2016 we have been strong proponents of the ‘slow growth, low inflation’ environment as the overarching investment backdrop. Although we are more than three years further on, we see little reason to change that view. The pace of economic growth, while positive, is still well below rates experienced in previous decades. Meanwhile, inflation, in the developed world at least, remains far below the 2% target set by most central banks.

In such an environment, the boom–bust scenario that typified previous cycles has moderated and interest rate volatility has fallen. We don’t believe this business cycle is dead, but it has elongated and we think it could run further still. Financial accidents remain a risk, such as the accumulation of debt in China, and geopolitics could play a part. But they are tail risks and our expectation is for this record economic expansion to continue for now.

Macro drivers: medium-term environment

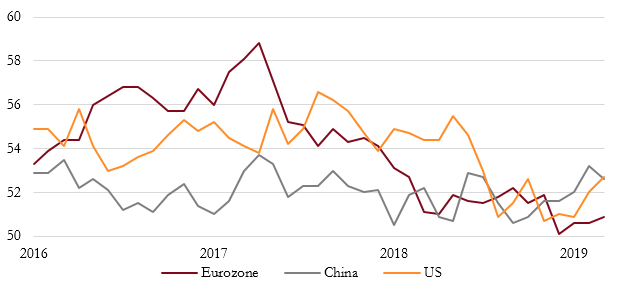

For a couple of months now we have been talking about a potential inflection in macro momentum and a reversing of the slowdown in economic activity that we’ve seen over the past 18 months. Recent data supports this view as we have seen European and Asian manufacturing PMI data rebound off its lows, non-manufacturing data continue to show robust growth and employment trends are strong.

PMIs

The Purchasing Manager’s Index is a reliable leading indicator, surveying a broad section of the manufacturing sector and gauging consumer demand. Data over the past three months has started to show improvement after a prolonged contraction.

Source: Saranac Partners.

Yet not all data is so positive. US manufacturing is a conspicuous outlier as it has slowed further in recent months. European industrial production remains negative and we have relatively low expectations as to the strength of the rebound.

Nevertheless, a rebound in growth would be well received by markets and it is apparent that investors are gaining confidence in this narrative. 2019 finished on a strong note with a whiff of the ‘market melt-up’ in equities and credit as investors focused on the improvement in macro data.

We noted that valuations have crept back up to the highs last seen in early 2018 and the central question we now face is how much of the good news is already priced in?

Signals: short-term indicators

The sharp rise in risk assets over the year-end has seen our sentiment indicators move into extended territory, implying that markets may have gotten ahead of themselves and over-optimism is a risk. Notably, our sentiment indicators have typically been more useful in highlighting what actions not to take at extremes. The current environment does not seem well suited to increasing our risk exposure in portfolios.

However, it is not a foregone conclusion that markets need to fall in order to correct overly positive sentiment. We have seen similar levels of optimism in the past, which have resulted in little market volatility. The signal is relatively weak at this time and we would highlight the important distinction that the underlying momentum of the macro environment is turning positive.

We haven’t experienced an inflection in global growth to the upside since 2016 and we are conscious that a positive economic backdrop such as this may well be supportive to markets.

Valuation

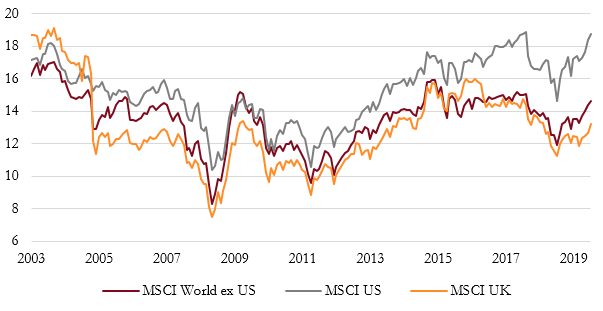

Recent market strength has moved not only sentiment into extended levels, but also valuation. US equity valuations expanded throughout the year and are now close to their prior peak of January 2018. Credit spreads (the premium in yield paid by corporate bonds for the additional credit risk over government bonds) for both investment grade and high yield bonds are at cyclicals lows.

Measuring value

Forward price-earnings ratios for US companies have surged ahead of other regions over the past few years.

Source: Saranac Partners.

Valuations outside the US are far less extended, although they too have risen. However, the margin of safety offered by Emerging Market or European equities is higher. We have written before as to why we believe the US deserves its premium valuation, not least its superior record of earnings growth and profitability, and our largest regional exposure within equities remains the US. However, as we expect growth to improve broadly across the world in 2020, there may well be opportunities to invest outside the US at cheaper valuations.

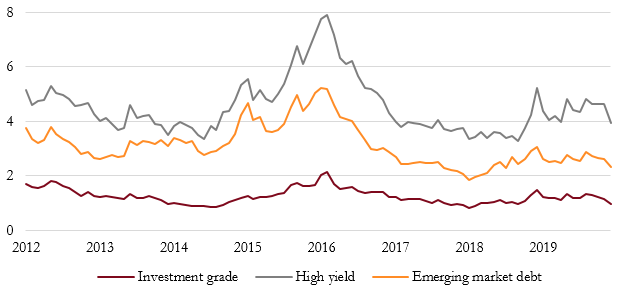

Credit spreads

Credit spreads express the difference in yield between two bonds. When measured against government bonds, investment grade, high yield and emerging market debt yields have been falling recently as investors remain confident about risky assets.

Source: Saranac Partners.

The tight level of credit spreads suggests that excess returns earned by higher risk credit over government bonds should be lower than last year. However, we are not concerned about default risk in the near term as recession still looks some way off and so exposure to these higher-yielding bond markets is warranted.

KEY QUESTIONS FOR 2020

US presidential election

Markets appear relatively relaxed about the US presidential election in our opinion, suggesting they believe that the market-friendly Democrat candidate (Biden) will be successful in his bid for nomination, but that Trump will ultimately prevail on 3 November.

As we move through the year, we expect the market to increase its focus on the potential Democratic candidate, more specifically the prospect of Senator Elizabeth Warren securing the nomination. US equity markets are not yet reflecting election uncertainty and, with the exception of the US managed care sector, there is currently limited evidence of US industries suffering from policy uncertainty.

US /China trade

Progress on a ‘phase one’ trade deal between the US and China paused near-term trade uncertainty, however significant challenges remain for both parties to make progress on a ‘phase two’ agreement. We expect negotiations between the US and China to be complex and protracted, with no clear path to a comprehensive deal. A lack of progress and subsequent frustrations on either side are a key risk for markets in 2020, as too is the potential for the US to shift its trade focus to Europe.

Trump impeachment

As we wait for Congress to pass the articles of impeachment across to the Senate, we believe this process is already dead in the water given the Republican majority in the Senate. Impeachment is a political process, not a legal one, and Senate Republicans have made it clear that they will support the President. The odds of achieving the two-thirds majority required to actually impeach Donald Trump are slim indeed. Nevertheless, it does highlight the partisan divide within Washington and the real risk that the presidential election could result in legal challenge, as it did with Al Gore and George W Bush. Any such threat to the legitimacy of the election result would no doubt be destabilising for markets in the short term.

US/Iran tensions

We expect tensions to persist between the countries but ultimately believe that both parties are incentivised to avoid a full-scale confrontation. President Trump has likely welcomed the recent distraction from domestic impeachment proceedings, however we think war with Iran would be damaging to his re-election prospects, especially given his stated views that the US should extract itself from the Middle East. Full-scale war is also not in the interests of the Iranians, particularly given recent internal unrest and demonstrations. This said, we acknowledge the prospects of an accident in the region and expect energy prices to remain supported as long as tensions persist.

Brexit

There is now scope for Brexit to become less relevant for markets, particularly in the short term, but with the potential to flare up periodically, particularly if the prospect of no deal at year-end were to resurface. It is also the case that a government with a large majority will be more stable than the previous minority government, and this should help reduce the risk premium on UK assets. Our central expectation is that the UK government will try to negotiate a deal on goods relatively quickly, enabling it to demonstrate some momentum, but leave the services sector to be dealt with over the longer term.

Tech leadership

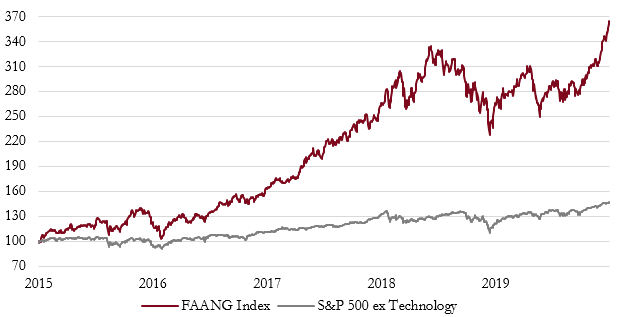

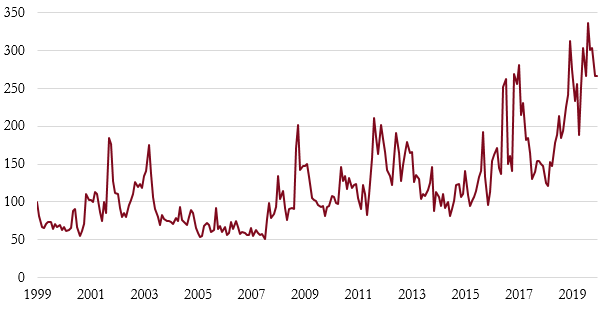

Concentration of equity market leadership in a few names is a factor we watch, as it suggests a broader weakness in markets and reliance on a few mega-cap names. Tech was the clear winner in terms of sector performance in 2019 and much has been made of the pre-eminence of the internet and tech giants, the FAANGs, there is no doubt that market leadership was quite concentrated in these names last year. We would like to see a broadening out in participation among stocks. This would support the thesis of a stronger macro outlook, and the recent outperformance of emerging market and European stocks is encouraging.

That said, we still believe that the impressive top-line growth and free cash flow margins generated by many of the tech leaders justifies their position at the front of the pack and their valuations are far from the speculative levels seen during the dot-com bubble of the late 1990s. In a world of relatively slow growth, the ability to generate sustainable, above-average growth is likely to be rewarded with a premium valuation.

Relative performance of FAANG stocks

The FAANG Index comprises the share prices of Facebook, Amazon, Apple, Netflix and Google. Mega-cap tech and internet names have led markets higher to an increasing degree. We would like to see broader market participation and less emphasis on a few star names to sustain a healthy market advance.

Source: Saranac Partners.

Inflation

Once again the dog that didn’t bark in 2019, inflation remains quiescent and well below the 2% target set by most central banks in the developed world. Wage inflation is seen as the most likely catalyst for a broader uptick in prices, particularly given the cycle-low levels of unemployment in the US, UK & Europe (3.5%, 3.8% and 7.5% respectively). However, wage growth remains steady and overall inflation figures have moved little over the past 12 months.

US inflation, as measured by the Fed’s favoured index, the Core PCE, is at 1.6%, while Eurozone inflation (CPI) has fallen back to 1%, Japanese core inflation is stuck well below 1% and UK core CPI has slid to 1.7%. Economic slowing, weak trade and moderating goods prices have all contrived to keep inflation low, while it is unclear whether labour’s bargaining power is strong enough to demand faster real wage growth given the broad decline of the unionised labour force. A re-acceleration in trade and global GDP, plus a move higher in oil prices due to Middle East tensions, could lift inflation somewhat from these low levels.

However, we continue to believe that secular trends in technology, supply chains and Chinese overcapacity will keep a lid on inflation such that the risk of a sharp tightening in monetary policy due to an inflation shock is low. Trade wars and disruption to the global supply chain do not help in the long term, but to date the response from manufacturers has been to take the margin hit rather than try to push prices higher.

GLOBAL ECONOMY

Global Economic Policy Uncertainty Index

This index covers 20 major countries and the frequency with which their national press discusses economic policy uncertainty. Although geopolitical risk has risen in recent years, the extent of economic policy uncertainty has also risen sharply.

Source: Saranac Partners.

US

The US is something of an outlier at present, as economic data still shows a manufacturing sector that is deteriorating and shrinking. Much of this may reflect an inventory cycle that is at a different point to the rest of the world and the US is still working through its bloated inventory. However, the consumer remains in great shape due to low unemployment, real wage growth and a de-levered balance sheet.

The fall in interest rates through 2019 should also see a pick-up in residential real estate activity. CEO confidence and business investment are areas of weakness, and any positive developments in trade negotiations would be a positive at the margin, but we do not attach a high probability to this. The Fed has moved to a neutral stance and is likely to remain on hold for a while, but it has equally highlighted its willingness to cut further if economic softness prevails.

UK

The hope is that a degree of certainty with regard to Brexit might unleash some of the pent-up demand and investment that has been held back over the past two years and see the UK economy accelerate. However, once the withdrawal agreement is passed, attention will then turn to the actual trade deal and the deadlines set by Boris Johnson, ensuring that clarity into the future relationship with Europe will remain in short supply. Nevertheless, we would expect some short-term relief from the Brexit fatigue which may lift the economy, and there is the very real prospect of a degree of fiscal stimulus this year which could be the strongest of any European economy. A new governor of the Bank of England in March somewhat clouds the outlook for monetary policy in the UK, but the probability is that interest rates will remain on hold for the foreseeable future and any movement is likely to be down rather than up.

Europe

The European macro backdrop remains fragile but is starting to show signs of modest improvement. We expect Europe to benefit from reduced near-term trade uncertainty and a subsequent global manufacturing bounce, while the avoidance of a hard Brexit and diminished Italian political risks have removed additional headwinds. Fiscal policy will be slightly more expansionary in 2020, but not enough to give Europe the boost it needs. The ECB, under Christine Lagarde’s new leadership, has defended current monetary policy settings for now, but due to the diminishing effectiveness of policies, we expect her to increase the pressure on European governments to offer greater support through fiscal levers.

China

Growth in China continues to tail off and we expect GDP to end 2020 closer to 5% from the current 6% level. Progress on a ‘phase one’ trade deal with the US provides short-term relief, while the 450 basis points of cumulative cuts to the Chinese banking reserve requirement ratio (RRR) since the beginning of 2019 help support the financial sector. We expect the Chinese government to continue fixed asset investment at levels required to support the economy, while further RRR cuts are likely over the course of the year should data suggest they are required. Chinese authorities appear to be adopting less aggressive easing measures than in previous downturns, suggesting that they are focused on the long-term shape of the economy and sustainability of growth