Macro environment

July saw further evidence of a sharp initial rebound from the trough in activity in the second quarter as lockdown pressures eased.

Purchasing manager indices (PMIs), one of our favourite and more timely economic indicators, showed another move higher for both the manufacturing and the non-manufacturing sectors in the US and Europe to levels associated with robust growth. However, we would note that these surveys measure the improvement of conditions month on month, so respondents are comparing current conditions to the recent, very depressed levels of activity and actual output still has far to go to reach prior peaks.

Other more lagging macro indicators show a similar picture of a rapid rebound in growth. Industrial production in Europe was up by 8–9% in July. However, the year-on-year picture still shows a loss of more than 10% in output.

Second-quarter GDP reports confirmed just how deep a recession most economies had suffered. US GDP was down over 8%, Germany contracted by 10% and Europe by 12% overall. The UK fared the worst, experiencing a 20.4% drop in GDP – the worst outcome since WWII.

Economic surprises are still leaning to the positive side, especially in Europe, but we expect the pace of recovery to moderate as we move through the third quarter, in part due to the more difficult comparisons on a month-on-month basis. But we also acknowledge that progress in opening economies up and reversing the restrictions of lockdown has been uneven and slower than first hoped, particularly in the US but now also in parts of Europe and countries such as Australia.

The US dollar has been particularly weak since June, falling some 10% against a basket of other currencies, and has emerged as a significant new macro theme. The difficulties containing the virus in the US and the consequent slowing in efforts to reopen the economy has seen the macro momentum of US data slow relative to other parts of the world, and this may have put pressure on the dollar.

Furthermore, the scale of fiscal stimulus will see deficits in excess of $3.7 trillion this year in the US and could be close to $5 trillion depending on the outcome of the current negotiations on another stimulus package. The size of these deficits may well be weighing on the dollar at the moment, but given that the US is far from being alone in running large fiscal deficits as a result of the pandemic, we do not foresee a sustained fall in the dollar and expect it to stabilise in the near term.

Scenarios

Our scenario analysis showed little change from June and we continue to rule out the possibility of a sharp V-shaped recovery. Slow normalisation remains the central case but there was a modest increase in the possibility of greater bumps in the road to recovery and a more extended slump in output.

Corporate earnings

The second-quarter earnings season presented another positive surprise for markets as over 80% of US companies beat earnings expectation, a record proportion.

That’s not to say that earnings were strong. On average, US profits fell 40% year-on-year, their worst performance in over 10 years. However, investor expectations had been set at low levels after the first-quarter earnings reports and these proved to be overly pessimistic.

Companies have clearly managed their profit margins and cost bases carefully as revenue growth failed to surprise to the same extent as earnings, with fewer than 60% of companies beating revenue forecasts.

European earnings suffered an even greater fall of over 70%, in part because of the greater exposure to problem areas such as financials, energy and auto manufacturers, while the ability of European management to generate positive surprises was also somewhat lacklustre, with less than 60% of earnings reports beating expectations.

The positive impetus from US earnings helped the US equity market make further gains over the month, but progress was more limited in other regions.

The pre-eminence of technology, healthcare and internet businesses in the US has been an important factor in driving the outperformance of the US market overall relative to the rest of the world, and July was no different. Indeed, while the S&P 500 is now only down 1% or so from its prior all-time high in February, just six stocks (the FAANGs of Facebook, Amazon, Apple, Netflix and Google, plus Microsoft) have contributed a gain of 4%, while the other 494 stocks were down a little over 5% in that time. Such concentration of performance in the hands of so few companies is not a helpful environment for sustained gains in the equity market overall.

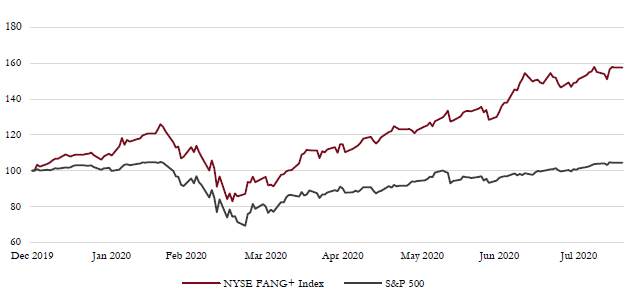

FAANGS vs S&P500

The outperformance of the FAANGS relative to the S&P500 has been dramatic so far this year.

Source: Bloomberg & Saranac Partners.

Regions where tech is less prevalent have been more rangebound and European markets were down on average in July, as were Japan and the UK.

Inflation and bond yields

We strongly believe that the impact of COVID-19, in the near term, will be deflationary due to the collapse in demand and surge in unemployment.

However, we recognise that there is an important debate to be had about the longer-term impact on inflation of both supply chain disruption and the need to re-tool more local supply chains, as well as the sheer scale of fiscal stimulus currently being applied to the global economy.

In the meantime, central banks have laid out their policy in clear terms and there is a very low probability that the major ones will be raising interest rates until late in 2022 or beyond. Indeed, investors now expect central banks to tolerate higher inflation in the immediate future than would otherwise have been the case, such has been the difficulty in achieving the 2% inflation target over the last decade. Certainly a higher level of inflation in future would help governments inflate away some of the massive debt burden currently being accrued.

This may help explain why long-term inflation expectations over the past three months have been steadily rising and have now recovered to levels seen pre-pandemic, having rebounded from the lows in March of just 0.6% to 1.6% today, despite the deflationary forces currently in play.

While actual bond yields have remained anchored at very low levels, this rise in inflation expectations has been a key determinant for market performance in recent months. The real yield offered by government bonds, that is the nominal yield less the expected rate of inflation, has fallen dramatically as nominal yields have been static but inflation expectations have risen. Whereas in late 2018 real yields were priced at around +1%, now they offer -1%. This has had important consequences for a number of asset classes.

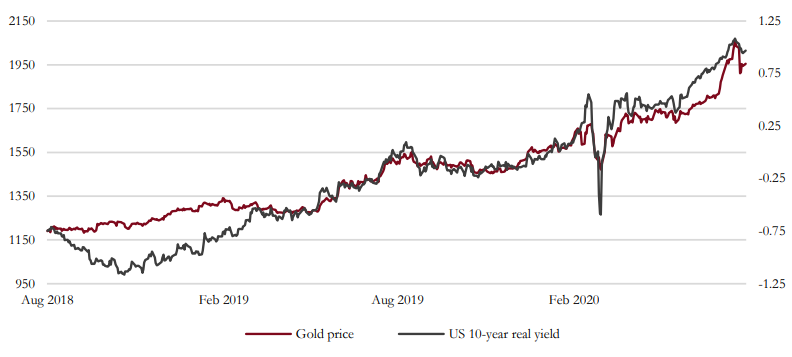

Gold was a standout performer in July, rising over 10% and blowing through the magic $2,000 barrier in early August to set new all-time highs. Negative real yields have historically provided a very positive backdrop for gold prices and so has proved true again, with a tight correlation between gold price appreciation and the fall in real yields.

Real yields vs gold

The correlation of gold and real yields has been strong over the past three years

Source: Bloomberg & Saranac Partners.

Assets with particularly long lives, or long duration, have also benefited disproportionately from this fall in real yields. Gold is one such asset, but large-cap growth stocks would be another obvious beneficiary, as would infrastructure.

We think it is important to note that real yields, at -1%, have now fallen to the lowest levels since 2012 during the eurozone crisis. We believe they are unlikely to fall further. This could have consequences for the degree of outperformance enjoyed by growth stocks, in particular technology, and cap further gains in the gold price.

Risk appetite

Our risk appetite sits slightly below par at the moment as we factor in the risk that the macro momentum fades later in the year and COVID-19 disruptions escalate.

Furthermore, the US presidential election has the potential to unsettle markets as it could see the rhetoric against China step up a notch or two with implications for trade and further tariffs. A Biden win looks probable, for the time being, and while this may be positive for global relations it could be difficult for financial markets given the likelihood of tax increases, greater regulation and fiscal spending under a Democrat administration.

More immediately, the need to extend the stimulus programmes in the US to help offset the impact of lockdown is imperative, but a deal in Congress seems far away. Further delays could do material damage to the prospects for sustained recovery in the US economy and see negative revisions to growth forecasts into year-end.

On a more positive note, any progress with regard to a vaccine would likely be taken well by the market and could be a catalyst for a broader participation in the recovery. Sectors somewhat left behind in this rally, given their economic sensitivity and more depressed outlook, would likely benefit the most from the prospect of a more normal economic environment in 2021.