We have been highlighting early signs that the outlook for the global economy is brightening for a couple of months now. Further encouraging data since the start of the year pushed stock markets higher in anticipation of a healthier economic backdrop.

Markets then suffered a fall after a new coronavirus spread rapidly in China. Several large cities were locked down in Hubei province, whose capital, Wuhan, is where the virus broke out.

Zeitgeist: the long-term context

Although there is a risk that the virus could affect global supply chains and disrupt businesses, we believe there is no reason to change our longer-term views about the investment environment. Despite record low levels of employment in the US and other developed countries, there are few inflationary pressures.

The pace of global economic growth is likely to remain at or slightly below its long-term average, and there are few signs of any excessive imbalances. Yet central banks appear committed to maintaining easy monetary policies, and could even accelerate their stimulus measures if the coronavirus becomes more disruptive.

Geopolitical risks remain. Trade tensions between the US and China have stabilised, but the situation in the Middle East remains volatile, and the US presidential election adds uncertainty.

Macro drivers: medium-term environment

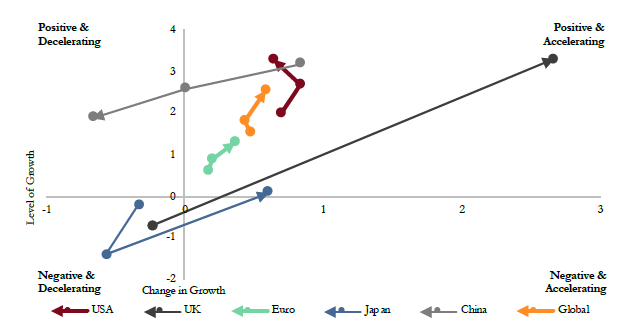

Manufacturing surveys are now rebounding, and our macro indicator has shifted firmly to its positive quadrant. Economic data in the US is now joining the upswing following a period of weakness, which could be a positive response to the recent ‘phase one’ trade deal with China.

Macro indicator – Manufacturing surveys are now rebounding, and our macro indicator has shifted firmly to its positive quadrant (top right).

Source: Saranac Partners.

Many leading indicators are now climbing higher for the first time since early 2016. For example, the Citi Economic Surprise Index is showing that most data is coming in ahead of expectations, especially in the US and emerging markets.

The pace of economic growth could suffer a short-term dip if the coronavirus disrupts businesses and consumers. Although financial markets appear to be looking through the situation as a temporary phenomenon, we’re not so sure the mood will remain positive if the outbreak becomes more serious.

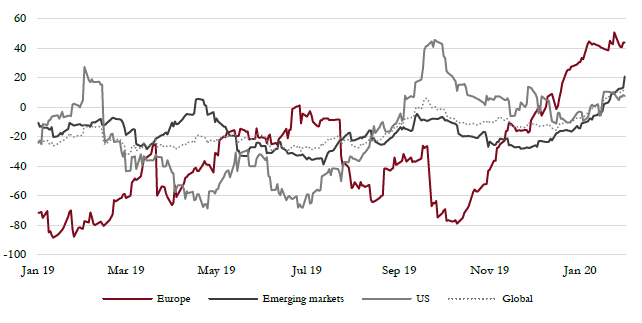

Economic surprise indices –Economic indicators have been coming in ahead of consensus forecasts recently.

Source: Bloomberg.

Signals: short-term indicators

Our risk indicators had increased sharply in recent weeks as markets rose strongly in anticipation of a re-acceleration in growth. However, they have since returned to more typical levels as markets dipped after the first reports of the coronavirus, particularly in emerging markets.

Growth and momentum factors continue to outperform value substantially, while small cap is lagging behind large cap. Given the extent of momentum’s recent outperformance, we are watching for signs that momentum has run too far, which could trigger another bout of volatility and rotation into other areas of the market, such as value.

Although most industry sectors have participated in the stock market’s recent rise, concerns remain that a lot of the performance has been driven by a few of the world’s largest companies. Yet this pattern has been less prevalent as companies have reported their earnings from the fourth quarter of 2019.