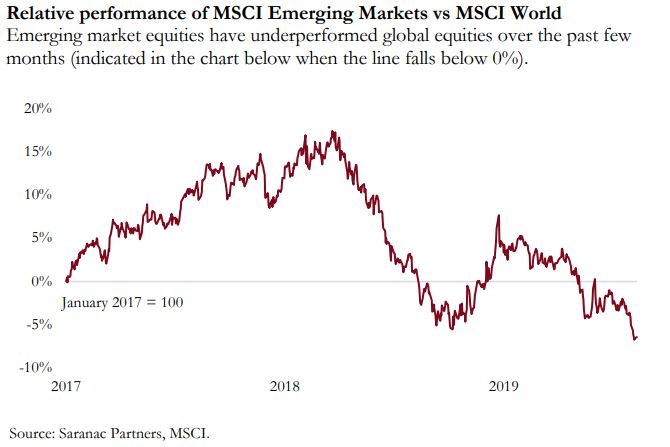

Despite a central scenario of continued subdued but stable growth, we have rotated to a more defensive stance in portfolios. Global monetary policy has shifted to a more supportive stance and while this may struggle to stimulate faster growth, it should perpetuate this economic cycle further still. At the same time, US–China trade woes and a global slump in manufacturing has reduced our expectation of a global recovery in the second half. Furthermore, geopolitical tensions in Asia and recent volatility have highlighted the vulnerability in markets.

Zeitgeist: the long-term context

We have not changed our view on the overarching economic context. The investment environment is characterised by subdued economic growth, low inflation, and an unstable political background. We continue to believe that the economic cycle has further to run.

In this context we forecast modest equity growth and record low fixed income yields. We view alternative investments as an important diversification tool and believe gold will continue to perform as a safe-haven asset.

Macro drivers: medium-term environment

There has been a significant easing of the monetary environment, with 80% of central banks loosening monetary policy. In this supportive policy environment, we do not expect a significant correction.

Signals: short-term indicators

Recent volatility together with the deteriorating picture around US–China trade talks has highlighted the vulnerability of markets. We have therefore taken a more defensive positioning in portfolios while not changing our fundamental view on the medium-term market environment.