Our central scenario continues to be a stabilisation of global growth at low levels and the avoidance of a recession. This is driven by a supportive monetary policy environment globally and the emergence of looser fiscal policy.

Zeitgeist: the long-term context

Our central long-term thesis of slow growth and low inflation remains unchanged and we continue to believe we are not heading for a near-term recession. However, geopolitical factors also continue to play an outsized role in the market outlook and we are therefore taking a cautious view of the economic environment.

Macro drivers: medium-term environment

Our central view of subdued growth and avoidance of a recession in the near term is supported by a globally accommodative monetary policy and an increasingly supportive fiscal environment. Similarly consumer spending, particularly in the US, remains an area of strength.

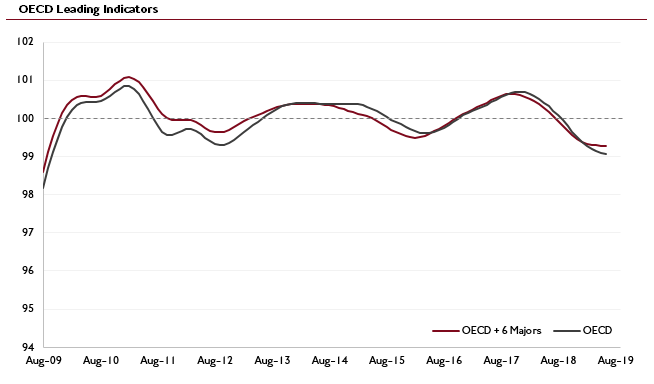

However, there has been a clear erosion in aggregate momentum and we have therefore increased our view of the probability of a recession, albeit from a low base. Geopolitics, and in particular the ongoing impasse between the US and China, is leading to a marked slowdown in the industrial economy. Furthermore, we believe there is little impetus for corporate investment to increase in the short term.

Signals: short-term indicators

Market sentiment is broadly negative and there has already been a significant rotation out of equity and into bonds over the summer. There is therefore a limited risk of disappointments in terms of negative macroeconomic data.

Equity valuations are neutral and far from expensive or speculative. However, earnings growth forecasts for 2020 have been largely untouched despite reduced growth expectations for 2019. As a result, consensus expectations appear high and it is probable there will be earnings downgrades in 2020.

Bond yields have fallen sharply in recent months and are at record lows in some countries. As a result, there is a possibility that yields have fallen too far and too fast and may rebound in the near term if the risk of recession declines.

In aggregate and as a broad indicator, our risk appetite lies between 3 and 4 on a scale from 1 to 10. We are therefore cautious on the near-term outlook, but not outright bearish.

Graph showing the OECD composite leading indicator which highlights the recent loss in moment evidenced by the trend line dipping below the 100 level. 100 represents the long term potential level of economic activity. This indicator is used to help identify turning points in the business cycle.