Global GDP growth slowed significantly during Q3 but has been showing encouraging signs of a reacceleration in recent weeks. The Citigroup Global Surprise Indices have all turned up as economic data has surprised to the upside, having been in downward trends for much of 2021. PMI manufacturing survey data and output numbers have also been relatively strong.

However, the most recent developments in the spread of Covid and the new Omicron variant have raised uncertainty levels. It is still far from clear as to whether or not this pick-up in growth will be short-lived. However, even if renewed restrictions on economic activity are introduced, the market’s reaction may not be extreme if investors think they will just be temporary.

Inflation has continued to climb, in part due to strong commodity prices. Another reason is supply chain issues, which are pushing the prices of specific goods much higher, such as used cars. We had expected these supply chain disruptions to start to be resolved by now but it has become apparent that the problem is as much excess demand as it is constrained supply. Demand is showing no signs of easing off just yet and the interconnectedness of the global supply chain means these problems now seem likely to take another 12 months to fix.

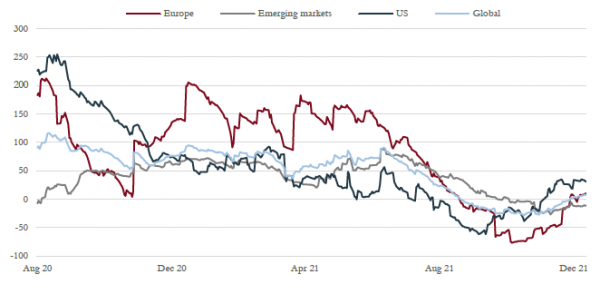

Economic Surprise Index – Economic surprise data has turned positive after a period of negative revisions, suggesting economic momentum has reaccelerated in recent weeks. It is unclear if the Omicron variant will derail this recovery.

Source: Saranac Partners.

Inflation expectations

This situation could well maintain inflationary pressures for longer. The US Federal Reserve (Fed) has made a clear shift in its outlook on inflation. Recent announcements have stopped using the word “transitory” in the inflation outlook and turned more hawkish on monetary policy and tapering QE.

Nevertheless, we expect inflation to peak soon and start to fall back as we move through next year. We also recognise the likelihood that inflation will fall back to a higher level than the pre-pandemic long-term average.

US real wage growth – Wage growth has failed to keep pace with the recent surge in inflation, meaning real wages are negative. Typically, this pattern would be concerning for growth, but the huge accumulation of savings over the pandemic may cushion the blow of these falling real incomes.

Source: Saranac Partners.

One concern we have is that wage inflation is failing to keep up with headline inflation, and therefore real wages are getting squeezed. Declining real wages can be ominous for the global growth outlook. Yet this factor may not impact growth to the usual extent because huge savings have been built up through the lockdowns, in addition to generous fiscal and monetary policies. These savings may cushion the blow of negative real wage growth for a while.

In fixed income markets, the yield curve has flattened after shorter-duration bond yields moved higher to reflect a more hawkish tone from central banks. Another reason is the expectation that US interest rates will rise by the middle of 2022 rather than the end of this year. However, longer-dated bond yields have generally fallen as investors believe inflation will be contained in the long term, while the Omicron variant has also pushed up the price of safe-haven assets.

US yield curve 2yr – 10yr – The additional yield offered by long-dated bonds over shorter-dated bonds has compressed since October as earlier rate hikes have been priced in by the market, which should temper inflation over the longer term.

Source: Saranac Partners.

Equity markets continue to be volatile and rotations between value and growth stocks have been sharp and sudden – there have seen two small corrections in the past three months. In general, growth has been outperforming value since June, when the Delta variant became dominant.

The earnings outlook remains a positive feature and investors are far from over-optimistic. However, valuations could be threatened if inflation surprises to the upside. We’ve made some changes to portfolios recently by taking advantage of raised volatility and also some distressed pricing in specific markets.

Investment environment

On a 12-month view we have seen a shift to a more cautious investment environment as the tail risk of recession has appeared in our forecasts and the current environment of strong growth has faded. Lower inflation and above-trend growth remain central to our outlook in the near term, which is why we continue to favour equity over fixed income for now.

However, expected returns are lower than they have been for much of this year. Our risk appetite levels are slightly above average, but have also come down modestly.

Fixed income

Recent data has been dominated by strong inflation and job numbers, leading the Fed to move to a more hawkish stance and the possibility that it will begin to taper QE sooner than planned. The market had already moved to this view and in many ways the Fed is simply catching up.

The yield curve has flattened by 50bp since early October due to upside pressure on the front end of the curve combined with a small decline in long-term bond yields. This is the market telling us “inflation is not transitory – the Fed will have to hike sooner than expected but this may damage the long-term economic outlook”.

There are now five interest rate hikes between now and 2023 priced into the forward curve, but very little after that. The market believes that if the Fed hikes rates to 1.5% it will be sufficient to bring inflation under control and back within its 2% target range. Forward inflation curves confirm this view because medium-term inflation is still priced at 2.1%. However, expectations for inflation over the next two years are much higher, at around 3.2%.

Most recently, the flattening of the yield curve has been accentuated by renewed Covid restrictions in Europe, the new Omicron variant and a move to safe-haven assets such as long-dated US Treasuries.

With a flatter curve, the yield offered by bonds with around a six-year maturity are only marginally lower than those offered at the long end, so there is little incentive at this time to extend duration.

The short end of the yield curve seems to accurately represent the likely progression of monetary policy over the next year. However, we still believe that longer-duration bond yields will rise because when the Fed begins to taper QE, the process should curb the suppression of real yields.

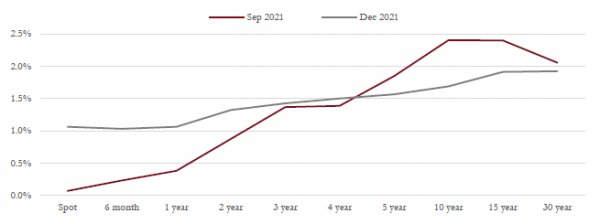

Year US Treasury forward curve – Market forecasts for one-year US Treasuries have moved sharply. Yields over the next two years are expected to be much higher than forecast in September, reflecting the belief that the Fed will raise rates much sooner. However, there is also a shift in expectations that bond yields in the long term will not need to rise as much due to lower inflation and slower growth, which is a consequence of earlier rate hikes in the near term.

Source: Saranac Partners.

Equities

Q3 company earnings continued the trend of positive surprises, despite concerns over margins given the inflationary picture. The degree to which forecasts are revised higher is inevitably slowing. One result of rising forecasts for corporate profits is that equity markets now appear better valued, despite strong returns.

Concerns over growth and the reopening of economies due to Covid variants has seen growth stocks outperform cyclical and value stocks in recent months. Despite the challenges facing the more cyclical areas of the market, we have retained our exposure to these kinds of companies because valuations and positive revisions through 2022 continue to look attractive.

Typically, we have a bias towards growth stocks. However, we are avoiding those companies with the highest valuations and lowest profitability given their vulnerability to changes in both the inflation outlook and their own growth dynamics. Growth at a reasonable price looks to be the preferred strategy at this point in the economic cycle.

Commodities and currencies

The US dollar has once again proved the consensus wrong because it has been the strongest major currency this year, despite the overwhelmingly negative view at the beginning of 2021.

Higher inflation and a gradual move in thinking by the Fed to a stance that is likely to see interest rates rise in mid-2022 (as opposed to 2024 as was originally expected) has supported this upward move in the dollar. In contrast, the euro has seen less inflationary pressure, while the ECB has made little change to its policy outlook.

Sterling has been positioned somewhere in between the dollar and euro. The Bank of England has been signalling for some months that it wants to raise interest rates in the UK to combat inflation, but has yet to do so due to growth concerns over both Covid and Brexit.

Despite its strength, we believe the dollar looks fairly valued against most other currencies. Sentiment has improved and investors are positioned to take advantage of further strength.

The consensus has ended up being wrong many times in currency markets in recent years. However, we do not yet see the extremes in views that have occurred previously and so the positive momentum in the dollar may continue.

Dollar strength is often a headwind for gold and other commodities. Yet the main move in these markets in November was the drop in the oil price following the announcement of the Omicron variant. Travel restrictions and slower economic growth could damage oil demand just as OPEC is raising supply, which would be good news for motorists who are facing petrol prices not seen for over a decade.