As we move into February, our investment narrative and analysis continues to be focused on three key themes:

- Economic growth versus elevated valuations

- Rotation from growth to value

- Search for diversification

Vaccines versus variants

In recent weeks, news flow around the virus has concentrated on the tussle between vaccine rollouts and the emergence of new variants. While vaccination programmes are starting to hit their stride in the US, UK and elsewhere, the emergence of new variants, issues of vaccine efficacy and the potential requirement for ‘booster’ doses has dampened some of the optimism around the revolutionary impact of vaccine programmes.

Our view is that some of this caution is overplayed. We believe that vaccines will work, lockdowns will ease in late Q1 or early Q2, economies will see significant reopening over the summer and growth will be very strong indeed in H2 2021 and into next year. We are therefore very much aligned with the consensus view that we are going through a period of weakness that will be followed by a very strong rebound.

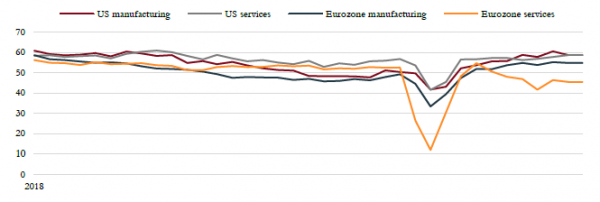

It should be noted that the current weakness is specific to both the service sector and Europe. There is broad-based strength in manufacturing globally and PMI numbers remain high.

US and European PMIs – US and European PMI survey data show manufacturing remains on a strong growth path. Services, however, are mixed as the impact of lockdowns in Europe are evident, while US activity is surprisingly resilient.

Source: Saranac Partners.

The service sector has also held up far better in the US than Europe, where US authorities have taken a noticeably different approach to the second wave of coronavirus infection and resisted a full national lockdown response.

Valuations

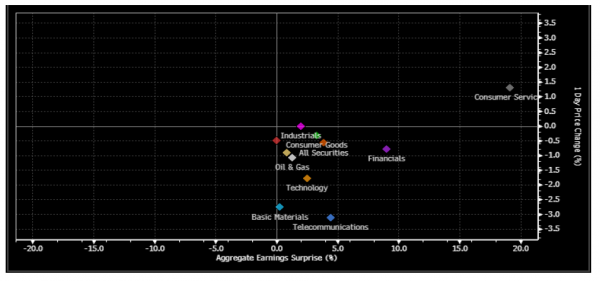

Despite the optimistic consensus on economic growth, valuations remain problematic and much of the good news on growth is already priced in. Stronger growth and positive earnings surprises could deliver further upside to equity markets, but on balance valuations are likely to compress this year. Q4 2020 earnings have so far beaten analyst expectations by record levels, yet the market response has been generally negative. This muted response implies most of the good news was already in the price, although a lack of positive guidance with regard to 2021 also plays a part.

Q4 2020 earnings reaction- The vast majority of stocks in the S&P 500 have fallen in the immediate aftermath of their results, despite Q4 earnings season being the best on record for positive surprises. Much of the good news around better profitability and a generally stronger corporate environment is already in the price.

Source: Bloomberg, Saranac Partners.

Short-term sentiment remains overly optimistic – investor surveys are bullish and positioning in the derivatives market suggests investors are fully invested and reinforces the bullish view. The Reddit/Robinhood drama over attacks on highly shorted companies highlights both growing retail participation in this market, as well as heightened focus on social and wealth inequality within the market system. While the GameStop episode raises lots of questions for market participants, from a valuation perspective it relates to a very small pocket of companies and is not something that should be extrapolated across the market more broadly.

In contextualising current valuation levels, comparisons with the tech bubble of 2000 highlight some similarities such as retail participation, IPO activity and loss-making companies on high valuations. However, the differences are notable and substantive – monetary and fiscal policy is much more accommodative, expected earnings growth in the near term is higher, fund flows are normal and historic performance is still some way below the returns seen in the run up to 2000. On balance, therefore, our risk appetite is not bearish, but does remain cautious and unchanged.

Inflation

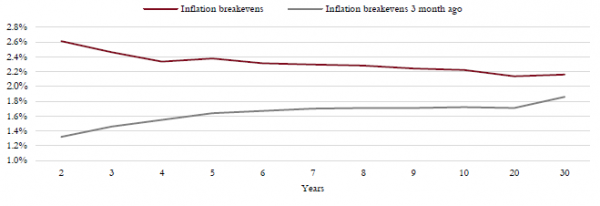

As noted in our previous communications, inflation is a critical driver of market dynamics and something we are monitoring closely. Inflation expectations have continued to move higher in the US and Europe, but they remain at relatively low levels, reaching 2.2% in the US and just 1% in Europe. UK inflation expectations have been stable at 3%.

We would note, however, that expectations for inflation over the next two years have risen more sharply and are now higher (2.5%) than expectations for the next 10 years (2.2%). We would agree with this view that there are temporary, cyclical factors that could drive up inflation in the short term but which are unlikely to be sustained – commodities and shipping being two key contributors. Our scenario analysis now gives greater credence to a pick-up in inflation, but only to levels slightly higher than seen pre-Covid-19. We firmly believe that a return to ‘high inflation’ above 3% or 4% is highly unlikely.

Inflation expectations- Inflation expectations have shifted higher over the past three months and are back to levels seen prior to the pandemic. Unusually, near-term inflation is expected to be higher than long-term inflation, a result of the run up in commodity prices and shipping costs as the global economy bounces back from the disruptions of 2020.

Source: Bloomberg, Saranac Partners.

Furthermore, despite the potential for higher inflation in the near term, we do not expect central banks to change their policy stance. Given fears of tightening too soon and a target of ‘average inflation’, a loose policy stance is likely to persist, even if inflation were to run above target for a while.

This is crucially important as markets are particularly sensitive to monetary policy now, given high valuations and the expectation of low interest rates for a very long time. We don’t think the Fed or other central banks are likely to change their narrative this year, even if growth and inflation are stronger than expected, due to the extent of the damage from Covid-19 and the lack of growth and inflation in recent years. Furthermore, central bank policy is pushing real yields negative in developed markets – a situation governments are happy to maintain as it allows them to deflate their debt burden away, albeit very slowly.

Rotation from growth to value

As we noted in our last investment update, we believe there will continue to be a rotation into cyclical and value stocks as the growth environment strengthens in the second half of the year. We believe the shift to a period of accelerating and high economic growth will be more powerful and longer lasting than similar macro improvements in recent years. As a result, we think the outperformance of value relative to growth is going to last longer than the brief periods it did so in 2013 and 2016. Our investment approach is long term and so a brief flurry of performance from value-oriented stocks would not normally interest us. But this rotation in the overarching equity regime is significant enough to make meaningful changes to the style of our portfolio.

Nevertheless, it should be noted that our scenario analysis highlights our view that the underlying long-term macro environment is still one of low growth and low inflation. As this environment reasserts itself and the rebound from the supply and demand disruptions of 2020 and 2021 fades, so should a growth style of investing once more perform best.

Search for diversification

There is little value left in higher quality fixed income markets. Government bond yields have risen from their lows but remain well below pre-Covid levels. Nearly $16 trillion of investment grade debt still offers a negative yield. Credit spreads have tightened back to levels seen in 2019 and 2018.

With such low returns on offer we are looking for ways to generate better performance without compromising the risk management of the portfolio. Volatility remains high in many parts of the market and so we are actively looking for ways in which we can sell volatility and lock in relatively attractive returns with little downside risk. Structured products are going to play a more important part in portfolios going forward.