Traditionally the turn of the year marks a point for investors to take a step back, take stock and look ahead to the key dynamics, trends and themes of the coming year. In looking ahead to 2021 the slate of issues deserving of focus and attention is diverse and noisy, encompassing geopolitics, the green agenda, ongoing technological disruption and the continuation of a global pandemic. However, distilling these wide and complex issues into their impacts on markets, we believe there are three key issues that will dominate our thinking and approach to portfolios:

- Economic growth versus elevated valuations

- Rotation from growth to value

- Search for diversification

Economic growth versus elevated valuations

The key dynamic impacting the performance of markets in 2021 will be the tussle between underlying growth in the real economy coupled with already elevated valuations in markets. We fully expect 2021 to be a year of recovery and growth, with mass vaccination programmes together with economic stimulus and supportive central bank policy driving a resumption and acceleration of the global economy. This would normally call for a clear ‘risk-on’ orientation and a risk appetite of 8 to 9 out of 10.

However, equity valuations are already extremely high on an absolute basis. On a relative basis, equities look closer to fair value but much of that is due to the extraordinarily depressed level of global bond yields and the fact that fixed income markets are even more expensive, courtesy of interest rates at (or below) zero. Thus it is fair to question how much of the good news regarding growth this year is already priced in. In summary, this dichotomy causes us to be much more cautious than we would typically be in this economic context and we preserve our risk appetite at a level of 5 out of 10.

Growth

The dominant – almost binary – driver of growth over the next 12 months is the success of the vaccine in supporting a return to normal levels and patterns of economic activity. We already know the first quarter of the year will be dire for economic data. Europe will be hardest hit, with the US also experiencing severely depressed levels of activity. Even Asia, which enjoyed a strong second half to 2020, has seen some acceleration in the size and nature of outbreaks, likely leading to further social distancing measures.

The widely held expectation is that mass vaccination programmes will allow a return to normalised economic activity in the second half of the year and that government support and pent up consumer demand will drive a strong recovery. We do believe that vaccine roll-outs will have a significant impact on social restriction and therefore global growth. However, given the optimism around a ‘return to normality’ in the second half of the year, it will not take much for vaccinations to underperform expectations in terms of either speed of roll-out or efficacy of transmission prevention.

Other macroeconomic factors are likely to continue to support a global recovery. Government and central banks remain committed to significant stimulus and support for household incomes. Inflation expectations for the next 12 months are low as the global economy recovers from the deep Covid-19 recession. We also expect the geopolitical outlook for most of the next 12 months (after 20 January) to be calmer than in 2020 with the US election and the Brexit process completed, and a Biden administration likely to foster a more collegiate tone with respect to foreign policy.

Valuation

In previous cycles, this juncture would mark a period of high risk appetite, with low corporate valuations balancing uncertainty around the pace and trajectory of the economic recovery. However, 2020 and early 2021 has seen remarkable resilience and growth in corporate valuations to levels which seem extravagant on an absolute basis. US equity valuations, based on historic 2020 earnings, have surpassed all previous periods and are now even higher than they were in 2000, at the peak of the dot-com bubble. Admittedly, this is based on the depressed corporate profits of last year and, looking forward, valuations improve sharply due to the anticipated rebound in earnings. However, forward equity valuations are still in the top decile of their historic range and it would be unusual for future returns to fare well from such a starting point.

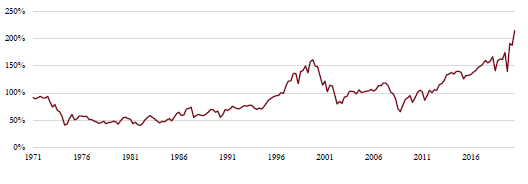

Looking at other valuation metrics, such as price/book or the ‘Buffett ratio’ of market capitalisation to GDP, US equities look equally stretched by historical standards.

The Buffett ratio – It is not just P/E multiples that show US equity valuations as high – other metrics are also stretched. The so-called ‘Buffett ratio’ measures the market capitalisation of the US market (here we use the Wilshire 5000 index) against US nominal GDP. This metric too is moving to unprecedented heights.

Source: Saranac Partners.

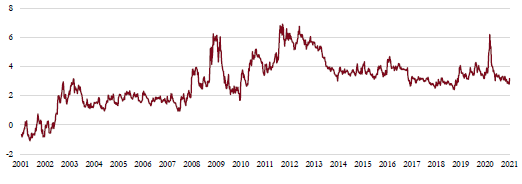

Much depends on the trajectory of interest rates over coming years. As we commented last month, if the US Fed remains committed to holding interest rates at current levels until 2024, as policy dictates today, then it is reasonable to expect valuations to remain at these levels for some time to come, no matter how uncomfortably high they look now on an absolute basis. It remains the case that equities, when compared to bond yields, still look reasonably valued, as evidenced by the equity risk premium, which compares the equity earnings yield to government bond yields.

Equity risk premium – Only on a relative basis do equities look attractive. The equity risk premium, as measured by the earnings yield of the S&P 500 relative to the US 10-year Treasury yield, is only in the middle of its historic range.

Source: Saranac Partners.

But the scope for valuations to move higher looks limited for sure. We therefore have a much more moderate risk appetite than would be typical in the early stages of a cyclical recovery.

Rotation from growth to value

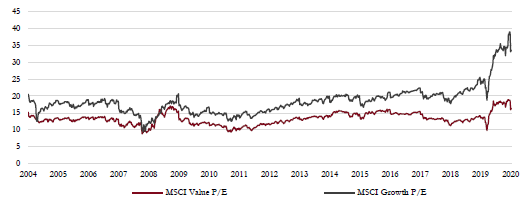

The past decade has been an unusually protracted one that has consistently favoured growth stocks. Low inflation and slow growth has placed a premium on companies that can deliver real growth, while cheap companies have lacked a catalyst to unlock their value. There have been periods in which value stocks have enjoyed a resurgence, such as 2016, but these have proven short lived.

Valuation disparity between growth and value stocks – MSCI valuation of growth and value highlights the dramatic widening of the valuation disparity between growth and value sectors over the past 12 months. Any move toward a normalisation of this relationship should see value stocks perform relatively well.

Source: Saranac Partners.

Towards the latter end of 2020 we began to see a significant rotation into less well-loved areas of the market such as energy and financials with expectations of a broader economic recovery.

Typically, as economies emerge from recession and growth rates accelerate, the value-oriented sectors of the market perform well, benefitting from this broadening out of growth to the whole economy and often surprising investors with the rigour of the improvement in their earnings and balance sheet. We expect this trend to continue in 2021 as we progress towards a more benign market environment in the second half. This is also likely to have regional implications, with Europe and Japan having a higher concentration of traditionally value-biased sectors such as financials, energy and industrials within their economies relative to the strong growth and technology focus of the US. These less well-loved areas of the market represent much more reasonable valuation levels with greater potential for upside.

Search for diversification

The ongoing nature of the ultra-low yield environment continues to pose challenges when constructing diversified portfolios. While we believe it would be premature to declare the death of the 60/40 portfolio, there is no doubt that government bonds will be constrained in their ability to offer meaningful protection to portfolios in times of stress, given the limited scope for interest rates and yields to fall significantly further from current levels. There will therefore continue to be a search for yield and for uncorrelated exposures across the investable universe.

At Saranac Partners we have expanded our fixed income holdings to include Chinese government bonds, which we believe will increasingly adopt more ‘risk-off’ characteristics. We are also turning to the currency markets as a source of diversification, conscious that for sterling investors currencies such as the Japanese yen have provided safe harbour from the storm during times of volatility. Gold has been an important diversifier to risk in recent months and we believe it continues to deserve an allocation in portfolios.

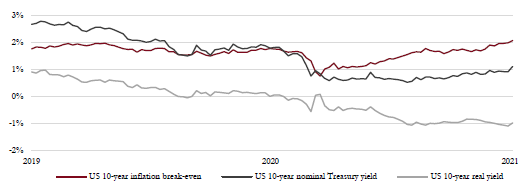

Inflation expectations have rebounded far more than bond yields since the recovery started and this has led the inflation-adjusted bond yield, or the real yield, to fall sharply into negative territory.

Government bond yields remain depressed – Inflation-adjusted bond yields (real yields) have fallen steadily over the past 12 months as inflation expectations have rebounded sharply but bond yields have lagged behind.

Source: Saranac Partners.

In the US, longer-dated Treasuries offer a negative real yield of -1%, a position that is supportive to the gold price. We do not, however, envisage a sharp rise in inflation in 2021 and so do not expect the gold price to surge further ahead as we saw in 2020. Rather, we see it as a helpful offset to risk and would be considering taking partial profits on our position if we were to see the gold price move meaningfully beyond $2,000 per ounce.

One further source of diversification can be found in liquid alternatives, or hedge funds. This is not without risk and we have seen successful strategies and managers suffer sharp drawdowns in unusual market environments. However, their ability to take advantage of market falls by going short, as well as benefit from other risk factors that are inaccessible to most investors in public markets, such as illiquidity and size, gives them opportunities to diversify their returns in such a way as to help our portfolios manage the market risks we face.