A year ago there was an unusually strong consensus that the medium-term macroeconomic outlook was for explosive growth. This scenario has been steadily slipping away. We now find our forecasts factoring in the possibility of a meaningful slowdown by the end of the year as financial conditions tighten, although that possibility is still only a small one. Nevertheless, whilst the outlook for growth has dissipated, from the perspective of covid and Omicron the prognosis is more encouraging today than it was a month ago.

Our expectations for growth are not the only forecast to have fallen. Expected investment returns have also dropped and we do not expect portfolios to enjoy the same performance this year as last. However, we think both equity and fixed income can generate low to mid-single digit returns in 2022 and our portfolios are positioned for such an outcome. In addition to lower returns, we expect markets to be more volatile as they digest the shift to tighter central bank monetary policies.

Inflation is the key issue and where market views diverge the most. We expect inflation to peak in Q2. We also believe it will fall back to levels above both those experienced over the past decade and central bank targets (in large part due to stubborn wage pressures and supported energy prices). Inflation is such an important question because it will be driving the pace of central bank tightening in 2022 and beyond.

Covid and inflation set the scene for investors

The Omicron variant has added a lot of noise to recent macro data and while recent economic growth has been strong, momentum has shifted from acceleration to deceleration. We are not convinced this is the true underlying trend.

Covid concerns are more likely to diminish than increase during 2022 and we see scope for positive demand surprises this year. In addition, supply chain issues should wane, although this process is likely to be gradual and many businesses only expect to return to normal by the second half of the year.

Monetary policy is tightening in much of the developed world, but it is still far from tight and in aggregate remains stimulative to global growth. We characterise the environment this year as consolidating – robust growth in Q1 should gradually fade but overall the global economy should expand at a rate above the long-term trend.

Another covid flare up is high on the list of possible risks this year, but we think inflation is the key variable. Persistently high inflation poses two risks. First, the erosion of aggregate demand as wages fail to keep up and real incomes and spending are squeezed, leading to a sharp slowdown in growth. Second, central banks are then obliged to tighten monetary policy more aggressively, which is likely to damage future growth expectations.

Our central case is that base effects will help bring annual rates of inflation down from current levels, but this process is only likely to get going late in Q1. Energy prices are an obvious source of easing inflationary pressure, as are more idiosyncratic inputs such as used cars, while the gradual easing of supply chain bottlenecks should also mitigate some inflationary pressures. Indeed, global surveys already point to improving supply chain dynamics.

However, there is two-way pressure on prices. One concern is that the significant rise in US house prices over the past year feeds through to US housing rent inflation, which is an important component of overall inflation.

Investment environment

The pace at which inflation falls will be an important determinant of short-term performance for both bond and equity markets but we see the broad direction as down. Nevertheless, the most significant move down is likely to be in the second half of the year and we do not expect inflation to fall back to pre-pandemic levels. A 2.5% to 3.5% range by year-end looks a sensible forecast, which would still be above the 2% target of most central banks.

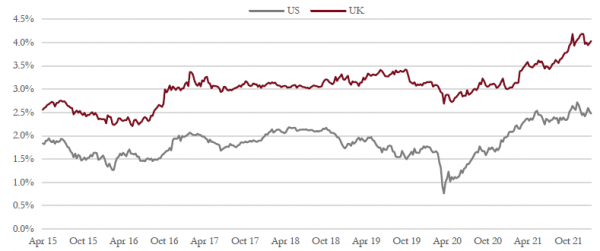

Inflation expectations have stabilised – Longer-term inflation expectations (10yr break-evens) in the US and UK moved higher through 2021 but there has been a clear levelling out in these expectations over the past three months. Near-term inflation may be high, but the future path suggests it will slow.

Source: Saranac Partners.

Equities

Record earnings growth drove strong returns in 2021, such that most markets finished the year on lower valuations despite the above-average performance. Earnings growth in 2022 is almost inevitably going to slow sharply but should still deliver high single-digit growth, which is better than the long-term trend.

Even though we see inflation falling through the year, it will still be high enough to generate good revenue growth for most companies. We expect some operational leverage to feed through to the bottom line, thus generating the high single-digit earnings growth.

US valuations are still at the high end of the range, but other markets look better value and some regions, such as China, now look genuinely cheap relative to their own history and to other regions. Broadly speaking, however, it is difficult to argue for equity valuations to expand in an environment in which the Fed is raising rates and monetary policy is tightening. As such, we expect equity market returns to be more in line with earnings growth this year.

China’s stock market looks good value – Chinese equity valuations (MSCI China P/E) are cheap relative to the rest of the world (MSCI World Index P/E), as well as relative to the market’s own history.

Source: Saranac Partners.

Regardless of region, growth stocks still trade at an unusually wide premium to value stocks and the relative performance between growth and value is likely to be determined by the pace at which inflation eases and the anticipated activity of central banks. If inflation is more persistent and bond yields rise further, we would expect value stocks to perform better than growth, as has been the case over recent weeks.

Conversely, a sharper drop in inflation than forecast could well swing sentiment back in favour of growth stocks and those companies able to drive earnings without the benefit of higher prices.

Our longer-term preference remains for high-quality, consistently compounding growth stocks. However, over the past year and a half we have owned a number of companies that would be better categorised as cyclical, in particular those that should benefit from the reopening of the global economy and removal of covid-related constraints on mobility.

The success of this approach has been inconsistent as pandemic concerns have flared up on occasion. However, we still believe this strategy will generate strong returns for portfolios, in particular as we move closer towards covid becoming an endemic, rather than pandemic, problem.

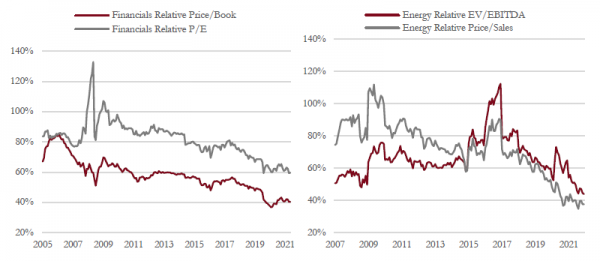

Two sectors that stand out as both cheap and well positioned for strong economic growth and potentially higher bond yields are energy and financials. While we have some exposure to these areas of the market, we continue to look for opportunities in these kinds of stocks.

Two sectors stand out as cheap – Financials and bank stocks in particular continue to look good value on a relative basis (left) as do energy stocks (right).

Source: Saranac Partners.

Very expensive growth stocks, which performed so well in 2020 and much of 2021, suffered a sharp reversal at the end of 2021 as their valuations have come under increasing scrutiny. This is a part of the market where we have very little exposure but we are assessing our equity holdings to ensure we are not vulnerable to a further de-rating of the more expensive end.

Fixed income

Much has happened in fixed income markets since December as the commentary from the Fed has shifted to a much more hawkish bias. The US central bank now recognises the greater threat of persistently high inflation, while the employment picture now looks unambiguously strong.

In addition, the market is now alive to the fact that not only is the Fed accelerating the tapering of its asset purchases, which will cease in March, but it is likely to start raising rates in March too. Previous expectations had been for the first rate hike this summer.

Lastly, and most recently, the market has reacted to Fed guidance that it intends to shrink its balance sheet soon after it begins raising interest rates, effectively engaging in quantitative tightening (QT). Following the financial crisis of 2008–09 the Fed took over three years to begin QT after initially suggesting the policy shift in 2013. This time the Fed is in no mind to wait that long, given the levels of inflation and health of the economy.

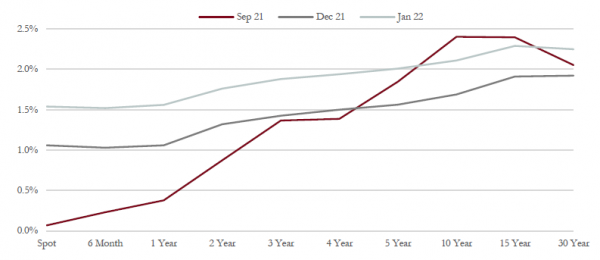

Bond yields have responded to these developments with a sharp rise across the yield curve. The shorter end of the US yield curve is predicting four rate hikes this year and another three next year, bringing US interest rates up to 1.6% by the end of 2023. We think such an outcome is feasible, although we are inclined to think the Fed may move a little slower than the market is forecasting.

US Treasury one-year forward curve – We highlighted the move in US interest rate expectations last month and this trend has accelerated further, highlighting why sentiment has shifted so much recently. Interest rates are now expected to be at 1.5% in 12 months, an increase of 50bp since last month and a dramatic change from where we were just five months ago.

Source: Saranac Partners.

Yields on longer-dated bonds have moved up since the start of the year but the move may not yet be complete. The effects of tapering, interest rate hikes and then QT could put pressure on US Treasury funding and see 10-year yields move further. The recent move has seen yields lift from 1.5% to 1.75% but we think 2% is achievable.

We sold our government bonds for most portfolios in the middle of 2021. If 10-year US Treasury yields move back up toward 2%, we would be interested in moving back into that market.

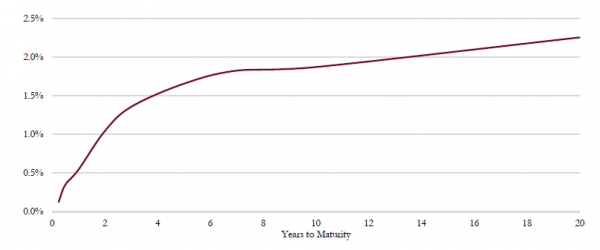

Currently the yield curve is noticeably flat between the 6- and 10-year maturity. There is little additional yield to be gained by moving further out the maturity curve. As a result, we are focusing our attention on the 6-year area of the yield curve.

Some parts of the US yield curve look attractive – The US Treasury yield curve is particularly flat between the 6-year and 10-year maturity, allowing investors to receive 95% of the yield of the 10-year bond for much less duration risk, which looks attractive to us.

Source: Saranac Partners.

Within credit markets, the additional yield spread over government bonds remains quite tight but is better value than where we were in mid-2021. We find more interesting opportunities within the BBB market. This is the lower-quality end of the investment grade universe but the strength of the global economy means that default risk is low. The energy sector, having been the source of so much default risk in the past two years, now looks in much better health as oil prices have recovered and management have been unusually prudent with their capital spending plans.

Given investment grade yields of around 3% at the moment, we think this is a fair reflection of the total return we might expect from this segment of the fixed income market this year.

High yield bond markets have also seen spreads widen a little. Following the move higher in government bond yields, the sector now offers yields of about 4.5%, which is a full 1% more than September 2021. Given the low default risk and short duration of the market, high yield remains an area where we want to have exposure.

Currencies and commodities

The US dollar enjoyed a strong 2021 as the Fed gradually caught up with the strength in inflation and the economy. Currency markets are positioned for further strength this year. However, the sharp moves in bond markets recently seem to adequately discount Fed activity over the next 12 months and we think the scope for any policy surprises is relatively small, at least from the perspective of tightening policy more than expected. This removes an important support for further US dollar strength.

Conversely, there is little activity forecast from the ECB or the Bank of Japan any time soon. There seems greater scope for surprise in those economies, particularly Europe where inflation is also high and there is the potential for a reopening surge in the region’s economy.

Sterling has traded in a relatively narrow band of $1.32 to $1.42 over the past year. We feel $1.36 is fair value, and are not expecting a significant move in the near term.

Commodity markets have seen a sharp rebound in the oil price, which is back to $85 after falling to $69 in early December on fears of economic weakness due to the Omicron variant. Despite a commitment from OPEC+ to add more barrels back to the market each month, there is a growing weight of evidence that the energy industry is no longer investing sufficient capital to maintain or grow production over the medium to long term.

Given the mounting pressure on all industries to lower their carbon footprint, it is of little surprise that the energy industry is circumspect about committing large amounts of capital to growth projects. However, the journey to reduce carbon intensity is a long and uneven one, demand will not fall lock step with supply and we expect there to be huge volatility in the energy space, which is certain to throw up investment opportunities along the way. Now may be such a time.

Gold had a disappointing 2021, in particular given the fall in real interest rates to very negative levels. This situation would typically have lifted the gold price. The strength of the US dollar was not helpful to gold and we suspect cryptocurrencies also diverted funds that may otherwise have propped up the gold price. Rising bond yields, in particular rising real bond yields, would create a difficult backdrop for gold in 2022, although any reversal in the US dollar would mitigate that risk.

We still hold a relatively small position in gold and it remains an attractive asset in hedging out negative tail risk events. However, the position has been a source of much debate within the investment team and we may sell our holding when we identify other diversifying strategies to hold in portfolios.