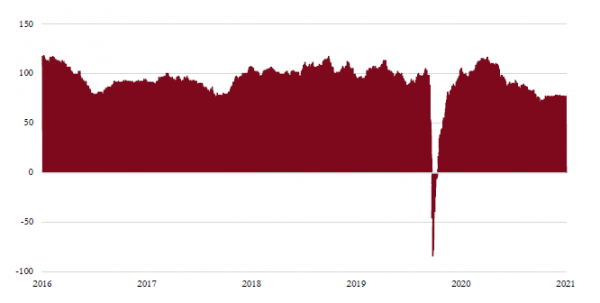

Economic upswing continues unabated, but with some signs that the period of ‘explosive’ growth may be waning. The purchasing managers indices (PMIs) reflect this trend by continuing to indicate a buoyant economy although at a slightly lower level than last month.

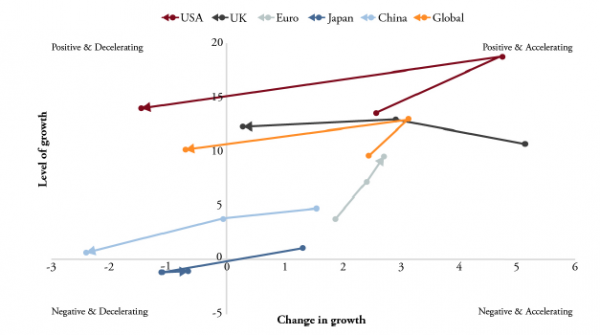

In past investment committee updates we have mentioned how we track the direction and momentum of the PMI data at a global and regional level. The global direction continues to be positive, albeit at a decelerating rate, but the regional indicators are a little more nuanced. Europe was previously a laggard, but has caught up with the US in recent months.

Global Growth Matrix reflects direction and momentum of PMI data – Positive and negative indicate the direction of the PMI number. Accelerating and decelerating indicate the momentum. We typically expect to see the global and regional level move between the top two quadrants. A negative and decelerating outcome can be an effective warning sign.

Source: Bloomberg, Saranac Partners

The trend in China’s economy is a little more worrisome as it points to slowing economic momentum. This is probably more to do with supply driven rather than demand issues. In summary we expect robust growth for the next six months or so. While some moderation is inevitable into next year, as the ‘reopening’ boost fades, we expect a firm growth environment even in 2022.

Monetary policy

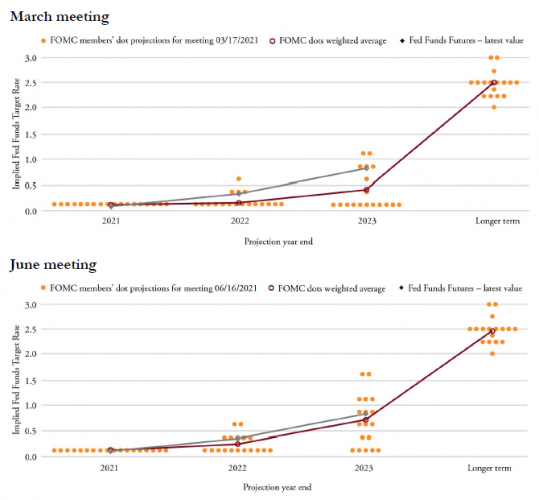

The Federal Reserve (Fed) initially sounded more hawkish in June as policymakers brought forward projections for the first post-pandemic interest rate hike to two interest rates in 2023 rather than waiting until 2024.

Fed market sentiment –The ‘dots’ represent the votes of the FOMC members in terms of level and timing on interest hikes, the red line shows the average weighted level of interest rates given how the FOMC members have voted whereas the grey line represents the market’s view. What’s interesting about comparing the two charts is how much the votes have changed specifically for 2023. This change has brought the FOMC weighted average dot line closer to the market’s view.

Source: Bloomberg, Saranac Partners

This was followed a week later by chairman Jerome Powell’s testimony before the House’s select subcommittee on the coronavirus crisis, which took a more dovish tone. It signalled a more patient approach to scaling back the central bank’s monetary policy support, which depends on evidence of imbalances in inflation or the labour market.

Macroeconomic risks

Last month we focused on inflation and our view that we do not expect there to be a regime change in inflation, has not altered. However, the market’s inflation expectations, as measured by subtracting the real yield from the nominal, has changed. It’s notable that the expectation for two-year inflation has moved down to 2.65% from a high of 2.95% back in May. 10-year inflation expectations have followed a similar trajectory from a high of 2.55% to 2.25%.

Corporate profitability has rebounded strongly in line with the macro picture and has been driven by a recovery in both revenues and profit margins. This has been reflected in equity market returns, which continue to push indices to all-time highs. However, revenue and earnings growth will probably reach a peak this year, which means year-on-year comparisons will be more challenging at the point where policy conversations will move away from the current highly stimulative stance.

We have also witnessed the oil price rise by almost 55% this year. Oil is a big input into the global economy, consequently a material rise can act as a global tax that can impact economic activity.

We acknowledge these risks as relevant. For now though the amount of liquidity that has been pumped into the market supports the global growth story. The US currently holds the above trend growth baton, which we expect will be passed on to Europe.

We feel the longevity of this staggered growth spurt, albeit at a slower pace, might not be fully appreciated and push the above-mentioned risks out into the future. Therefore, it is important to remain vigilant and continue to monitor these risks.

Having taken profit on the Euro Stoxx 50 call option position in June, our target equity allocation within a moderate risk portfolio is about 45% which is a reasonable level of risk given the current backdrop.