Markets continue to be volatile, with the second quarter proving to be another difficult period for investors. Over the first half of 2022, traditional balanced portfolios of 60% equities and 40% fixed income suffered their worst performance since 1932 as bond yields rose sharply and many equity markets entered bear markets. Commodities have been one of the few areas of positive return, although they too have seen sharp reversals in price in recent weeks.

For much of this year market attention has been dominated by the shocks of Russia’s invasion of Ukraine, China’s rolling lockdown in response to Covid outbreaks and the dramatic re-evaluation of monetary policy by the Federal Reserve (Fed). Inflation has been the common theme across these shocks and investor fears have centred on the possibility of an emergent stagflationary environment which would be damaging for both bond and equity returns.

Inflation has indeed continued to track higher but looks like it has peaked in some regions, with annual core inflation readings slowing in the US and UK. However, investor attention has shifted noticeably in recent weeks from the inflation problem to that of recession risk.

There has been a clear slowing in global macro momentum over the past quarter and this has prompted considerable attention on the possibility that the US, and much of the rest of the developed world economy, is inevitably sliding into recession as interest rates rise.

Recession risk

The investment narrative over recent weeks has shifted from one focused on persistently high inflation, and the likely central bank response to this problem, to the inevitable recession that seems all but certain to descend upon western economies later this year. Risk assets have dropped sharply and suddenly as these fears of recession have taken hold.

We are yet to be convinced that a global recession this year is inevitable and so here we lay out the case for and against such an outcome and highlight some of the reasons why this matters.

The case for recession in 2022

Consumer confidence in Europe and the US has collapsed to levels last seen during the financial crisis and the height of the pandemic, while CEO confidence has also dropped sharply. This does not bode well for spending and investment.

While wages are rising, inflation has beaten them to it and real wage growth has been falling sharply over the past two years, compromising overall spending. US retail sales also unexpectedly declined in May.

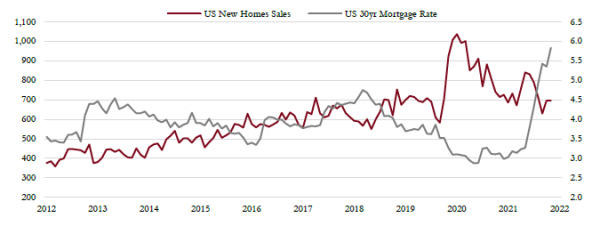

US mortgage rates have doubled to 6% this year, the fastest such increase on record, and housing activity, one of the key growth engines of any economy, is slowing as a result.

Energy prices have soared, petrol prices are close to £2/litre in the UK and $5/gallon in the US (a 60% rise over 12 months) which has inevitable consequences for spending on other non-essential goods.

Central banks are also tightening policy and interest rates are rising.

US home sales and mortgage rates –Economic slowing in the US as a result of higher interest rates and bond yields is evident in the drop in home sales as mortgage rates have doubled this year.

The case for no recession in 2022

It’s important to remember that recessions are uncommon. Central banks might be tightening, but monetary policy remains accommodative. Interest rates are still a long way below long-term inflation expectations and it will take some time before policy can be deemed to be tight.

The same applies to broader financial conditions which have tightened but remain far from levels associated with recession in the past.

Most economic data still points to economic expansion, albeit at a slowing rate. Indicators such as PMIs, employment and industrial production remain positive, although we must acknowledge this data is all backward looking and subject to lags.

The banking sector is in good shape and the willingness to lend and extend credit is undiminished, so there is no shortage of access to credit.

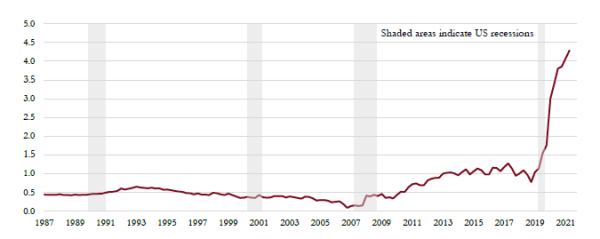

US consumer deposits soared by $3.5 trillion during the pandemic, rising from $1 trillion in 2019 to $4.5 trillion at the start of this year. This is a huge buffer to sustain some level of spending in the face of inflationary pressures and rising rates.

China is also trying to stimulate its economy for a strong bounce back in the second half of the year. The Chinese equity market has bounced 15% from its April lows in anticipation of a turn in the economy, although this too is dependent on Covid and an avoidance of further lockdowns.

US household savings ($ trillion) – US consumers saved over $3 trillion through the pandemic, putting household balance sheets in their best position for decades and providing a significant cushion to current inflation problems and economic slowing.

Source: Saranac Partners.

Why does this matter?

Equity markets have suffered a painful bear market already this year, but this has been entirely driven by a sharp fall in valuations, in part a response to much higher inflation and bond yields. The outlook for corporate profitability has remained largely resilient, despite these recession fears. There have been some downgrades to expectations for companies this year, but the profit bonanza enjoyed by the energy sector currently is offsetting much of this in aggregate.

If recession fears prove unfounded, or at least premature, then equity markets have fallen to levels where valuations look attractive and below their long-term averages. However, if recession does loom over the coming months, then we face another difficult period of adjustment as earnings forecasts are cut and valuations that optically look cheap prove to be expensive.

We believe that the case for a recession in 2022 looks premature, certainly in the US, although it is more marginal for Europe and the UK. Europe in particular looks highly vulnerable if Russia restricts the flow of natural gas, which would likely tip the region into recession. The German economy is especially dependent on Russian gas supplies.

Nevertheless, the arguments for recession look more compelling later in 2023 or even 2024, as we recognise that central banks have committed to a path of tightening interest rates for many months ahead, so the risk of an economic ‘accident’ at some point in the next 12 to 18 months is high.

Markets have been overly pessimistic in the near term in expecting recession soon and could be due a bounce. However, avoiding recession this year may prove cold comfort as the risks ahead remain elevated and the scope for a material move higher in equity markets looks limited until we are confident that inflation is under control, central banks are finished tightening and supply disruptions have eased off. We can expect a period of range-bound markets ahead until the conditions for a renewed bull market are in place.

Signs inflation is peaking

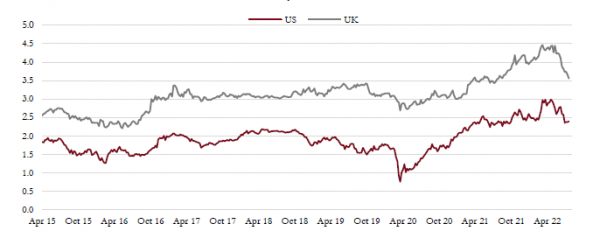

There are some signs that inflation is peaking from extreme levels, while market-based expectations for future inflation have fallen quite significantly over the past two months, reflecting confidence in the determination of the Fed to bring inflation under control. 10-year inflation break-evens (a long-term measure of expected average inflation) in the US have fallen from 3% to 2.4% since May, while the same measure in the UK has fallen from 4.5% to 3.6%.

Inflation expectations –Market-based measures of where inflation is headed show a clear shift in expectations of a fall back to normal levels over the next two years.

Source: Saranac Partners.

The inflation picture remains complicated as there are positive signs that supply chain disruptions are easing and areas of unusually high inflation such as used car prices have fallen sharply. Commodity prices have also fallen some 20% over the past month and therefore the impact of high energy and food prices on overall inflation will gradually dissipate as the base effects improve. However, other inputs into the inflation mix, importantly house prices and rent, are set to rise further as their impact is felt only after a significant lag.

Our expectation remains that we are seeing inflation levels peak now but the path to lower inflation will be a slow and gradual one, core inflation is likely to still be above 4% at year end and be around 3% by the end of 2023. In such an environment it is unlikely that central banks will reverse monetary policy soon.

Valuations have corrected sharply

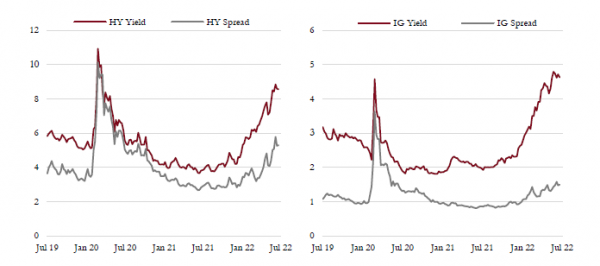

Fixed income markets have re-priced aggressively this year, UK 10-year gilts now yield over 2%, having begun the year at 1.1% while US 10-year Treasuries yield 3%, up from 1.6%. The move has been even more dramatic for credit markets as investment grade yields in the US have doubled to 4.6% and high-yield markets now offer yields of 8.5%.

US high yield and investment grade spreads – Bond yields have risen sharply this year but have stabilised over the past month as inflation expectations have eased. We see increasing value in fixed income.

Source: Saranac Partners.

The yield premium of higher risk credit over government bonds has widened sharply since May, reflecting the concerns over a possible recession in the near term and the possibility that highly levered companies may face default risk as a result.

Real yields have been relatively stable over recent weeks as moves in bond yields have been driven by changes to inflation expectations. Having started the year below -1.0%, the significant change in policy from central banks to a much tighter stance has driven real yields back into positive territory and they are now +0.6%, a level we think is appropriate given the inflation pressures in place and the need to moderate economic activity to bring prices down.

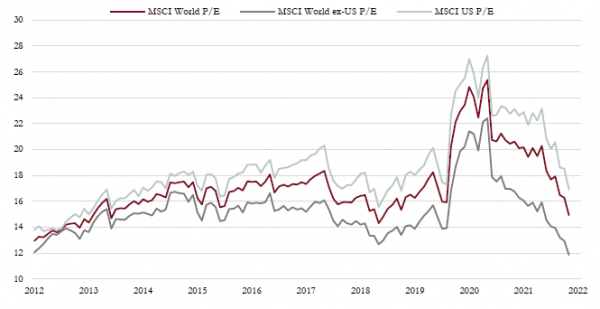

Equity valuations have corrected sharply and the bear market in equities has, to date, been entirely driven by the move lower in valuations. Markets outside the US now look demonstrably cheap on an historical basis, while the US valuation is also now below its longer-term average.

There is no doubt that part of this valuation correction relates to a re-setting of valuations back to more normal levels after the excesses of the post pandemic market in 2021. Areas of speculative valuation such as non-profitable tech have fallen precipitously and the speculative froth has now been eliminated; valuations for most growth companies are back to pre-pandemic levels.

Global equity valuations – Equity valuations have cheapened significantly across all areas. In particular, non-US markets now look to be discounting a very negative outlook.

Source: Saranac Partners.

Recent recession fears have punished cyclical stocks the most and many of these economically sensitive stocks are discounting a bad outcome for the global economy. This may be true in the case of Europe, but we think this looks premature in the US.

Relative valuations between these cyclical stocks and their more defensive counterparts have reached record levels, suggesting there is a strong consensus for recession but that much of this is already in the price.