The conflict in Ukraine could have profound consequences for markets and the global economy. However, we have no information edge as to how this crisis will be resolved. The situation is highly fluid and market reactions have been volatile as news unfolds. In such an environment of heightened uncertainty and significant swings in sentiment, we are not minded to make dramatic changes to our asset allocations.

Helpfully, global economic momentum has been strong coming into this year, with the impact of Omicron on activity less severe than feared. Economic surprises have turned positive in the last three to four months and growth is running above trend currently.

However, if resolution to the war is protracted then growth will slow, primarily due to elevated commodity prices and the ensuing hit to demand caused by high energy and food prices. Investor concerns are mounting about the possibility of recession in some geographic regions, particularly those that are heavily reliant on energy imports.

Such an outcome also raises the possibility of a stagflationary environment in which inflation remains stubbornly high but growth decelerates. Our own investment committee’s votes with regard to potential scenario outcomes would confirm this, as the probability of a stagflationary outcome, as well as the risk of the recession scenario, are rising (from low levels).

This is not, as yet, our base case for the economic outlook more broadly but we recognise that, for Europe in particular, a stagflation environment is possible. Central banks are facing a potential policy dilemma if inflation remains high and growth slows. Markets briefly lowered expectations for interest rate hikes this year as the growth outlook weakened, but the US Fed remains hawkish and is forecast to lift rates 8 times this year. We think that assumption will prove overly aggressive but it remains the case that the monetary policy backdrop looks very different in 2022 than to the past 2 years.

Investment environment

Equities

Sentiment is now extremely negative and has reached levels similar to the depths of the pandemic in March 2020. Risk assets have corrected sharply and unsurprisingly, European stocks have fallen the most due to the greater dependence on Russian energy supply and the sensitivity of the economy and earnings to the conflict.

Year-to-date European equities are down 10%, while many parts of this equity market are oversold on a short-term view. US equities have held up better in recent weeks although they too are down over 5% having also suffered a correction through January as interest rate expectations aggressively ratcheted higher.

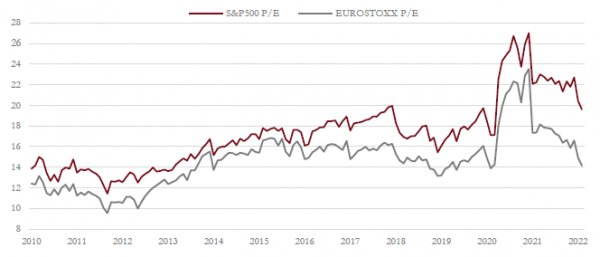

This correction has, to date, been entirely valuation driven as earnings forecasts have remained stable for the year ahead. Sentiment has deteriorated sharply and risk premiums are now much higher than where we started the year, value is starting to emerge in some regions although the US market continues to trade in expensive territory. Our appraisal of the valuation picture would suggest few areas of the market are discounting a recession, although some financial and cyclical stocks, especially in Europe, are pricing in a significant slowdown. Given our assessment of slowing growth, but growth nonetheless this year, the current equity set up seems fair.

Developed market equity valuation – P/E ratios have fallen sharply across all markets since 2020. The drop in valuations in 2021 was due to extraordinary earnings growth, but the most recent move lower has been due to the fall in market prices and the sharp deterioration in sentiment.

Source: Saranac Partners

While earnings forecasts have been stable, we are starting to see the remarkable run of positive earnings revisions come to an end. First-quarter earnings forecasts have levelled off and revisions are now more negative than positive for the first time since mid-2020.

Fixed income

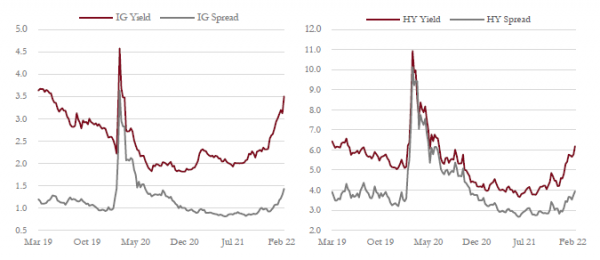

Credit spreads have widened, in line with the general risk-off sentiment, but spreads have, in the most part, moved back to long term average levels and are not signalling a more serious economic downturn.

Investment grade and high yield spreads – Corporate bond yields have risen significantly but much of this has been driven by the rise in government bond yields. Spreads have clearly widened, reflecting greater risks in the economy, but their levels are only back to long-term averages and do not suggest a more serious outcome.

Government bond yields rallied immediately after the Ukraine war began as safe haven assets were in demand but this move has since reversed given the inflation outlook and forward curves predict as many as seven rate hikes by the US Federal Reserve (the Fed) this year, on top of the first move made this month. In Europe, the European Central Bank (ECB) has backed away from predicting any rate hikes this year and is likely to remain well behind the Fed in lifting interest rates.

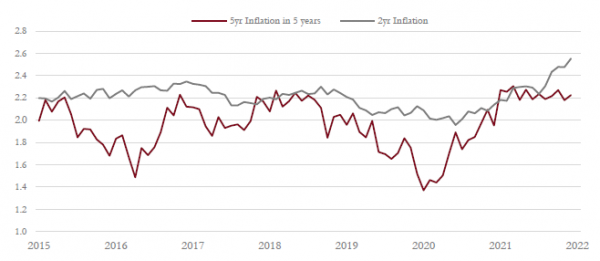

Short-term inflation expectations have risen sharply to reflect the spike in commodity prices we are now experiencing. Hopes of a robust drop in overall inflation over the coming months have faded due to this widespread pressure on commodity prices. Longer term inflation expectations remain reasonably well contained, but they too have moved higher as labour markets remain tight and policy is still relatively easy.

Long-term vs short-term inflation expectations in the US –The spike in commodity prices has seen short-term inflation expectations move higher to levels not seen in 20 years. However, it is expected that the Fed will tighten enough to bring inflation down as the longer-term expectations have remained relatively stable. Five-year average inflation in five years’ time is little changed over the past year.

While oil and natural gas have attracted the most attention, there have been sharp moves higher across all parts of the commodity complex, including industrial metals like nickel and soft commodities such as wheat.

Commodities

Russia produces about 10 million barrels of oil a day, representing around 12% of global oil supply and the rest of the world is incapable of replacing that production. Countries such as China and India are likely to continue to provide a market for Russian oil, but pressure is mounting for the west to sanction Russian energy production and the US and UK have already announced embargoes on Russian oil.

Efforts to advance the Iranian nuclear deal to bring back Iranian oil, pressure on OPEC to lift production and even talks between the US and Venezuela to revive production there, would still be insufficient to adequately replace lost Russian production in the event of major sanctions.

We believe that oil above $100 per barrel will lead to demand destruction and lower economic growth. Brent oil is now above $110 and if this level is sustained, or if the price continues to rise, then we can expect meaningful downward revisions to global growth estimates for the second half of this year.

With Russia and the Ukraine combined representing 30% of global grain exports, a sustained conflict is likely to see painful price rises in these commodities and raise the risk of further geopolitical upheaval in areas where grain imports are essential. The last time we experienced such a sharp rise in food prices was 2011, a period which coincided with political events such as the Arab Spring.

Whereas the move in energy and soft commodity prices is being driven by supply shocks to the system, gold has benefitted from its safe haven status, although it has been volatile, rising briefly above $2,000 before settling back in the $1950 range.

Commodity prices – The war in Ukraine has caused a sharp move higher in commodity prices across the board, which threatens the economic growth outlook and delays any fall back in inflation this year. Food inflation in particular could add further stress to the global geopolitical situation.