Since the beginning of the year, we have been focused on three key trends: economic growth versus elevated valuations, rotation from growth to value and the search for diversification.

Over the past month, however, a new factor has started to play a significant role in market performance, namely volatility in bond markets. While tied to prospects for economic growth and inflation, the recent pressure on bond yields relates as much to questions about Federal Reserve (Fed) policy and has become the key driver of returns.

Federal Reserve versus bond market vigilantes

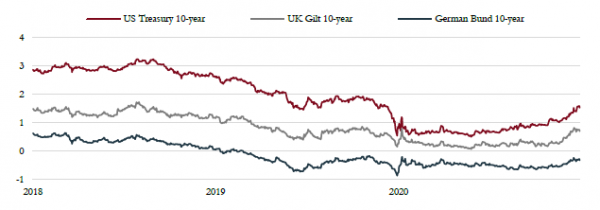

Bond yields have been rising steadily over the past six months, but accelerated sharply in February. Vaccine success and another huge round of stimulus from the US government (amounting to $1.9 trillion) has led to upward revisions in both economic growth and inflation. Global GDP is set to recover back to its 2019 peak by Q2 of this year, led by China and the US. Not only should economic growth bounce back but the outlook for inflation has also risen. Inflation expectations over the next five years in the US have increased to 2.5%, the highest level since before the Great Financial Crisis.

Global bond yields – Expectations for strong growth and rising inflation are pushing bond yields sharply higher and questioning central bank policy.

Source: Saranac Partners.

This booming macro backdrop has seen a resurgence in the idea of the ‘bond market vigilante’ – bond investors who won’t tolerate the risk of high inflation or policy mistakes and who drive bond yields to appropriate levels regardless of central bank promises. Deflation and disinflation have dominated the economic picture over the past 20 years and concerns over inflation have been few and far between. However, the combination of monetary and fiscal stimulus, swollen consumer savings accounts, and the prospect of a sharp snap-back in demand as COVID restrictions are eased have brought reflation and inflation back into focus. The recent spike in bond yields suggests that the Fed’s credibility and willingness to support an accommodative stance is coming under pressure and scrutiny.

If the Fed succeeds in convincing markets that rates will remain on hold for the next three years, despite faster growth and higher inflation, and long-term interest rates are headed for 2–2.5%, then the US 10-year Treasury yield is already priced at fair value at 1.4%. Given the stimulus and growth ahead, bond yields remaining well behaved would be very supportive for risk assets this year. However, we think the bond market is likely to test that presumption and challenge the current Fed policy position of keeping interest rates near zero until 2024. This is likely to lead to short-term volatility and the potential for further upward pressure on bond yields.

Historically, the Fed has proven itself to be reactive to market conditions and investor nervousness and has a poor record of acting pre-emptively. While we expect it to do ‘whatever it takes’ to maintain credibility and sustain accommodative policy, this may take time to resolve. A tightening in financial conditions brought on by higher bond yields and lower equity markets could well be what is required to prompt the Fed to act more decisively.

This could mean a revival of Operation Twist, further quantitative easing (QE) or even possibly yield curve controls where a specific Treasury yield is targeted, as is now practiced by the Bank of Japan and Reserve Bank of Australia.

However, we would not expect the Fed to act proactively in this regard, and further intervention and response will likely come about only after the volatility has started to hurt.

Economic growth versus elevated valuations

Little has changed with respect to the ‘growth versus valuations’ narrative over the past month and equity markets remain expensive.

However, we continue to believe in the potential for positive surprises, as forecasts for the pace of economic growth this year are being revised higher. We expect to see the same upward revisions to corporate earnings forecasts as the market is notoriously inaccurate in estimating the true leverage of companies to a sharp acceleration in growth.

This upward momentum to earnings expectations is likely to be the key positive catalyst for equities this year, given the current valuation constraints.

Rotation from growth to value

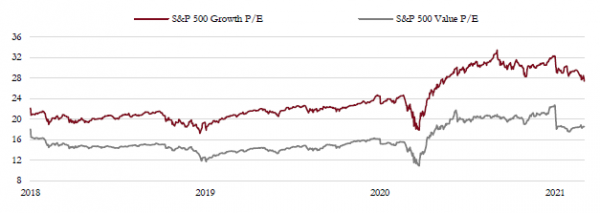

Ongoing volatility in the bond markets has and will continue to unsettle equity markets, and exacerbate underperformance of growth and momentum factors most sensitive to bond yields.

Both defensive and growth stocks are vulnerable to higher bond yields. Defensive stocks have long been sensitive to bond yields as their very stable business models give them bond-proxy characteristics. Thus, as bond prices fall, defensive stocks often struggle. Growth stocks have now also developed a sensitivity to bond yields. While faster economic growth should be positive for growth companies, their lofty valuations are dependent on interest rates remaining at low levels for some time. As bond yields rise, and with them expectations for higher interest rates in the future, these valuations come under pressure and could de-rate lower.

Conversely, a broad and robust recovery is likely to further support the outperformance of value and cyclical stocks as their earnings respond the most vigorously to the supportive environment. Furthermore, valuations for value and cyclical stocks remain very attractive relative to their growth counterparts.

Growth versus value – Equity valuations show that growth remains expensive relative to value in the US.

Source: Saranac Partners.

Search for diversification

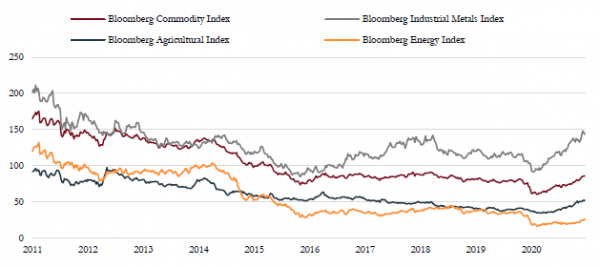

This month we considered the case for another super-cycle in the commodities market. The recent move higher in many commodity prices has led to conjecture that we are on the cusp of another period of extended performance from commodities, such as we saw in the 2000s (figure 3).

While we are clearly seeing an upswing in progress, we are sceptical that we are in fact seeing a super-cycle given the lack of structural forces to create long-term excess demand. There is no large economic bloc engaging in mass industrialisation (such as with China in 2000) and the effort to transition to a low-carbon economy is clearly going to create winners and losers in the commodity complex.

In the near term, we think much of the recent demand strength has been priced in and we would sound a note of caution with regard to China, where policy is much less accommodative and economic growth has eased off somewhat in recent months.

Commodity prices are rising – Commodity prices have surged over the past 12 months after a decade of moribund performance, but returns across commodities have been unequal.

Source: Bloomberg, Saranac Partners.

However, decarbonisation and renewable energy trends could see sustainable excess demand for specific metals such as copper and rare earths, while the outlook for oil, coal and other industrial metals such as iron ore is far less secure.

Furthermore, gold is under pressure as nominal bond yields have risen faster than inflation expectations. Another surge of volatility in bond markets could see gold prices fall back to pre-COVID levels.