What are the sources of concern? The macro background

At the start of the year, the Saranac view was that the global economy would be robust in the first half of the year as markets reopened post-Covid, before slowing in the second half and into 2023. Recession risk for 2022 was regarded as low, with the risks rising in 2023 – but these were only on the edge of the radar screen and given low probability.

Since that time, there have been three material shocks, some interconnected but all adverse. First, Russia’s invasion of Ukraine has caused a spike in commodity prices and higher inflation rates. This in turn has eroded real incomes and profitability globally, as well as eroding business and consumer confidence, particularly in Europe.

Second, the re-emergence of Covid in China has led to lockdowns in key cities. This has been a direct hit to growth in China and the wider region and has exacerbated the supply-chain challenges that had emerged after the initial lockdowns in 2020. The full impact of these lockdowns on the global supply chain have yet to be seen.

Third, the US Federal Reserve has re-evaluated monetary policy and there is now the likelihood of a much more aggressive tightening cycle than appeared likely at the start of the year.

What are the implications of these shocks?

These shocks have weakened demand, and at the same time exacerbated inflationary pressures. So the environment has become more stagflationary.

Stagflationary environments are challenging to equities and bonds. Inflation and the associated policy response pushes bond yields higher, and equities are depressed through the channel that combines weaker earnings growth with a valuation de-rating reflecting inflation volatility. Global equities are off by around 12% this year, similar to the losses in credit and longer-maturity government

bonds.

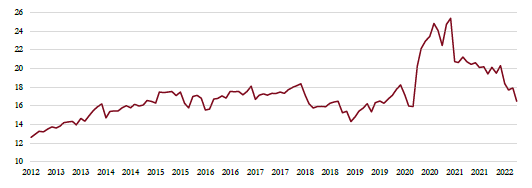

Equity valuations – Global equity valuations have dropped sharply this year, reflecting the joint concerns of inflation and growth.

Source: Saranac Partners

Whatever the macro views at the start of the year, these three shocks have the potential to deliver a materially worse environment from now into 2023 compared to these initial expectations.

What next? Assessing the shocks

It’s early days, and each of the adverse shocks can develop in ways that are favourable as well as adverse. Our assessment, necessarily tentative, is that in the first instance the China shock is material and adverse, but also potentially short-lived. It is feasible that it is at least partially reversed in the second half of the year though, of course, lockdowns can also persist for many months. There is little sign of any shift in policy by the Chinese government toward zero-Covid, but the National Congress held later in the year may well mark a shift in this regard. More conventional monetary and fiscal policy measures are moving increasingly to a stimulative stance to try to support growth.

The energy shock is also very material and has spilled over into a broader range of commodity prices, particularly food prices. However, commodity prices were relatively depressed to begin with and their recent rise takes them back to the level that prevailed for a good few years before the 2014 collapse, and well below the level reached in 2007–08. Similarly, there have been periods of significant food price inflation in the UK that did not trigger material cyclical downturns (although food and energy can rise still further). Clearly, the impact of higher energy prices is considerably greater for consumers in Europe and the UK than most other regions, and it is here that the erosion of real incomes will be felt most keenly.

Meanwhile, the US monetary policy shock has the potential to be the most adverse. The market is pricing in US short-term rates of 3.5% by end-2023. This level of rates does not appear particularly draconian, particularly in real terms. However, there are concerns that even this ‘modest’ level of short rates could trigger a severe slowdown if the economy is particularly interest-sensitive; or that a still higher level of rates will be required to reduce inflation if the economy remains robust, leaving only a narrow ‘channel’ of potentially positive outcomes. This strikes us a recurrence of the old ‘Goldilocks’ challenge; if interest rates rise too far, too fast then this could trigger recession (too hot), whilst a robust economy that doesn’t slow in response to higher interest rates could see inflation remain too high and further hikes required (too cold). Neither scenario augurs well for equities, although the former may see a rebound in long duration bonds.

Where are we now?

Economics

Economic data are now available up to April. There has been a very modest softening in economic activity globally compared to the start of the year, when growth was very robust. On a regional basis China and Japan have appeared weakest, with the Western economies more upbeat, including the euro area, which is most exposed to the Ukranian shock. Some confidence measures have weakened more significantly, but depressed consumers have carried on spending and business confidence surveys are more resilient. Moreover, recent data on economic surprises show little evidence of any material slowdown. In addition, first quarter corporate earnings growth was fairly upbeat, albeit tempered by more cautious guidance in some cases. It is early days, and there is plenty of time for effect of the adverse shocks to accumulate, but as of now economic activity has held up pretty well.

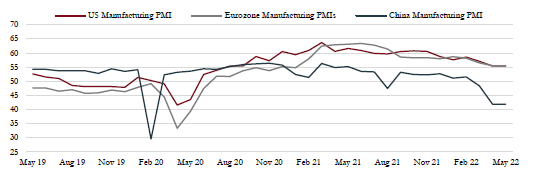

Manufacturing PMIs – Manufacturing surveys in the US and Europe have yet to show any material deterioration in expected activity, but China has slowed notably as Covid restrictions have hit.

Source: Saranac Partners

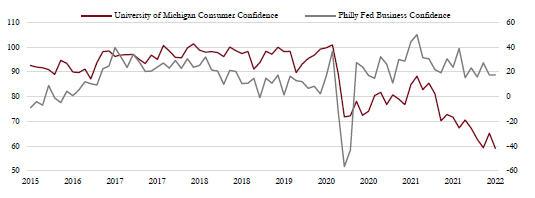

Consumer confidence – Inflation and the war in Ukraine have hit consumer confidence levels hard, yet business confidence surveys remain more upbeat.

Source: Saranac Partners

Market sentiment

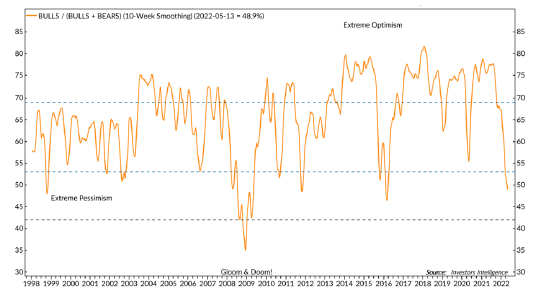

There appears to have been some genuine selling over recent weeks, and many indicators of sentiment are very depressed – some bull-bear readings are around the lowest levels since March 2009. Notably, there is a growing sense of capitulation amongst the retail investor as many stocks that rode the retail wave during Covid are now well below their initial prices from early 2020. There is a good case for a technical bounce at some stage.

Market sentiment

Investor sentiment is more negative than during the peak of the pandemic and this level of pessimism has only been exceeded during the Financial Crisis.

Source: Ned Davis Research; Saranac Partners

Equity valuations

Depressed sentiment is not, however, feeding into depressed valuations. The global price-to-earnings multiple has dropped back to around 16x, which is broadly in line with its average since 2014. The multiple would drop lower in a more stressed environment – for example, in the recession scare at end-2018 the multiple dropped to 14x, and yet there was no recession. We don’t regard equity valuations as remotely bubble-like, but neither have they dropped to anything approaching the level likely if recession pressures were likely to become more apparent.

Fixed income valuations

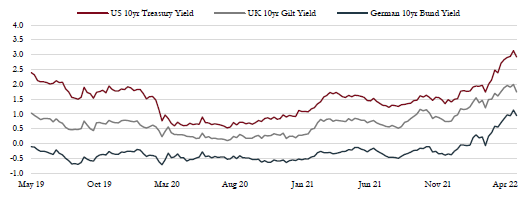

There has been material repricing of fixed income assets, with an upward shift in many countries’ yield curves following the aggressive pivot in US Federal Reserve policy. 10yr US Treasury yields have now topped 3%, a level briefly touched in late 2018 but otherwise the highest yield in over a decade. Credit spreads have also widened, although in the most part this is to long-term average levels and are not signalling stress in the economy. This repricing now allows scope for a potential extension of duration risk in portfolios, not an avoidance of this risk as in recent years.

Fixed income valuations – Bond markets have moved quickly to price in more persistent inflation and the associated tightening of monetary policy now expected.

Source: Saranac Partners.