In this month’s update we focus on rising inflation, the surge in the price of commodities and watching moves from the Federal Reserve (Fed) when it comes to interest rates.

Strong inflation numbers for the summer

The Consumer Price Index (CPI) report in the US was much stronger than expected – with a core rise of 0.9% – the biggest jump since 1981. The annual core CPI is now up 3%. But the base effects are important to take into account, as inflation numbers this time last year were very depressed in the midst of the pandemic, so we can expect a run of very strong inflation numbers over the summer.

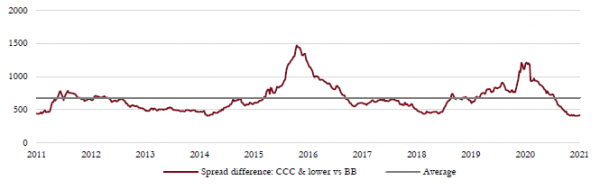

Even though we know the current figures are distorted by 2020 prices, inflation breakevens have moved higher. 10-year inflation expectations are now up to 2.5% – the highest since 2013 – while two-year breakevens are up to 2.8% – a level not seen since 2005. The fact that short-term expectations remain well above longer-term levels implies that the market believes the Fed when it says the rise in inflation will be transitory. Certainly, shorter-term inflation measures have moved much more than the longer-term ones.

Despite moves higher in inflation expectations, bond yields – having moved higher in February and March – have been more stable. As a result, real yields remain very depressed, at -1%. The lack of reaction from bond market shows that investors generally remain sanguine over inflation prospects too.

Inflation expectations – Future expectations of inflation can be derived from markets and the forecast of what inflation will look like in five years’ time has moved higher, up to 2.3%. However, this is still well below levels seen a decade ago.

Source: Saranac Partners

The longer-term inflation outlook has implications for portfolio management. We know there is a short-term blip in inflation coming, but there are longer-term disinflationary forces such as debt, technology and labour’s lack of bargaining power, which probably drag inflation back down. But there are potential catalysts for a ‘regime change’ in inflation to higher levels than we have seen over the past 20 to 30 years. Modern Monetary Theory (MMT) may be a game changer if adopted widely by western markets. Meanwhile, the slowing growth of the global labour supply, in particular in China, and the investment effort to de-carbonise the world’s economy could have inflationary impacts too.

The team’s view was consistent that a regime change in inflation still looks a long way off. MMT is far from becoming mainstream; automation and new labour markets (for example, India) probably limit labour supply issues; and clean energy investment will be a multi-decade effort. We believe the disinflationary forces in place over the past 20 years will prevail. But, ultimately, higher inflation for longer is now a legitimate tail risk, which wasn’t the case last year.

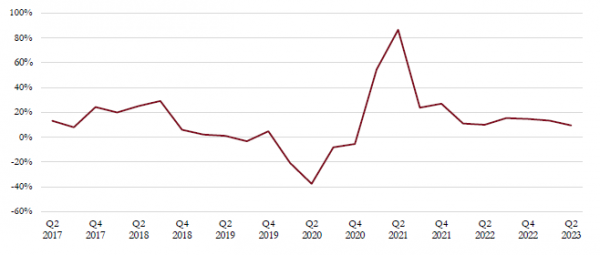

Commodity prices continue to hit new highs

As commodity prices continue to hit new highs, are there some signs of overexuberance? The longer-term supply and demand picture doesn’t point to a super cycle but we can see specific markets where supply is likely to remain tight for a while, and copper is a good example. Oil supply looks to be much more elastic given significant OPEC capacity and the ability for US shale producers to ramp up production very quickly.

There are good arguments that the drive toward clean energy and infrastructure investment will underpin stronger demand for certain commodities, but this investment tends to happen over very long periods and the lack of a China-equivalent keeps us from the super-cycle view. Economics 101 suggests very strong growth leads to higher commodity prices, so even without the super-cycle argument, the prospects for commodities remain strong as we believe prices are not yet discounting the full extent of the economic growth surge ahead. Ultimately, commodities are deeply cyclical, but we do not think we have reached the peak yet.

Watching the Federal Reserve

Watching the Fed is always a popular sport in markets, but never more so than now. Employment is clearly now the primary focus, while inflation targeting has moved to an average level, rather than a specific target. This is an important shift; average inflation targeting gives the Fed much more flexibility than a fixed target, so we expect it to resist a premature tightening of policy in the face of high inflation over the summer.

Forecasts for an increase of one million jobs earlier in the month proved dramatically over-optimistic, with only 266,000 added. Employment conditions in the US remain difficult and won’t fully ease until vaccinations are complete, schools have reopened and generous additional unemployment benefits are removed – hinting to September at the earliest. Some states have already removed the additional pandemic-related unemployment benefit of $300 per week. The data for people voluntarily leaving their job is at the highest in 20 years – a sign of both very strong demand for labour (there’s plenty of evidence that it is proving very difficult for companies to find suitable labour) as well the generosity of unemployment benefits currently.

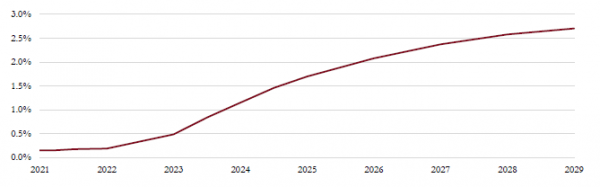

We believe the Fed has a clear chronological decision making process: Federal Open Market Committee (FOMC) statements will lay out the timing of the anticipated reduction in quantitative easing, then Fed asset purchases will be tapered over period of time – most likely 12 months given prior experience – followed by interest rate hikes. We expect the Fed to introduce timing guidance over the August and September timeframe, quantitative easing tapering to begin by year end, and to finish by end 2022. Interest rate hikes could be a 2023 event.

We think that there is a very low probability that the Fed shifts its policy messaging any time soon, though views on the team are somewhat diverse, from 0% to 35% probability. What is clear is that a hike from the Fed no sooner than the beginning of 2023 is fully priced into market expectations. Any suggestion that this timeframe be accelerated and brought forward would be a negative surprise, implying either that the labour market has recovered sooner than expected, inflation is running much higher than forecast, or both.

Federal Reserve interest rates – The timing of when the Fed will start to raise interest rates is a key variable for markets. Policymakers have said they not do expect to hike until early 2024. However, the market has moved forward its own expectations as to when monetary policy will tighten to early 2023.

Source: Saranac Partners