November began with some significant developments for financial markets. First, Joe Biden will almost certainly be inaugurated as America’s 46th president in January 2021 – despite Donald Trump contesting the result and votes still being counted in many states.

Second, BioNTech’s Covid-19 vaccine – developed with the help of US partner Pfizer and China’s Fosun – looks like it could become the first approved vaccination in the US and EU. This development allows markets to look through the pandemic with more certainty to a time when many aspects of the global economy face mounting challenges.

Macro environment

Regional divergences in the macroeconomic backdrop are widening. Many countries in Europe entered new lockdowns as Covid-19 infections rose, causing momentum to slow in their economies. Meanwhile, failure in the US failure to agree stimulus measures to support people and businesses is threatening to stall growth.

In contrast, China and Asia Pacific continue to outperform, both in terms of economic output and their ability to contain the spread of Covid-19. Overall, manufacturing is holding up much better than the services economy in all areas.

The broad message from the data is that the strong rebound in economic growth over the summer has slowed appreciably. We’re likely to face a difficult winter and a possible double dip in Western economies, while inflation risk seems as far off as ever.

The most recent news on vaccine development has been a positive surprise and has raised hopes that a vaccine may be available early in 2021, at least for the more vulnerable population. Although it is too late for a vaccine to make any difference to the economic momentum over the winter, there is much greater optimism now for growth prospects beyond the spring of 2021.

Scenarios

There’s been little change in the Investment Committee’s overall assessment, though time horizon is important. Near-term risks are mounting given the weak macroeconomic outlook, but the possibility of further stimulus could ultimately be beneficial to risk assets.

Our risk appetite remains around five and we attach a slightly higher probability to outcomes that have positive returns for portfolios than negative, but it is not a strong case.

Going forward, we believe a modest economic recovery is most likely, while we see recession or a spike in inflation as low risks.

Sentiment

Equity markets have suffered two corrections since they hit their highs in early September. There was a period of weakness during the run-up to the US presidential election, as much due to Covid-19 outbreaks and lockdowns as fears about the outcome.

However, going in to the election much of the uncertainty was already priced in and positioning and sentiment was no more than neutral. The VIX, an index that measures the stock market’s expectation of volatility, was elevated before the election, but fell dramatically when there was more clarity about the result.

Hedge fund positioning is far from extreme, with only a modest long bias in aggregate.

Valuations

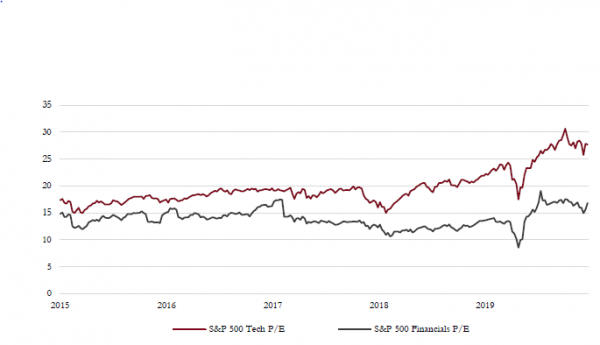

Equity valuations are showing wide dispersions. The secular winners and Covid-19 beneficiaries – including tech, healthcare and ‘new economy’ parts of the consumer discretionary sector – are trading at very high valuations and are discounting very positive outlooks.

S&P 500 valuation – ‘New economy’ tech valuations have diverged sharply from the ‘old economy’ financials sector, reflecting the differing growth outlooks of the two sectors. This gap has never been so wide.

Source: Saranac Partners.

Areas more sensitive to Covid-19 and value sectors – such as banks, energy and the ‘old economy’ consumer sectors – now offer much better value and are discounting very little growth. That forecast may be correct, but the gap remains unusually wide. US markets continue to trade at a significant premium to other regions, in particular Europe, which has suffered following news of further lockdowns.

Nevertheless, over the past two months, equal weighted indices have performed much better relative to the cap-weighted indices – a sign of a broadening in market participation and better performance from smaller cap names and value sectors. The recent loss of macroeconomic momentum and the likelihood of a much smaller stimulus package in the US (due to a split Congress), means that an important catalyst for a meaningful rotation out of growth and into value is lacking. But the recent news around vaccine development does raise the possibility of faster growth from mid-2021 and could encourage further broadening in the equity market.

Fixed income markets have been more stable than equity markets as credit spreads have continued to narrow (especially in high yield) and have suffered less volatility than equities. While yields are still at remarkably low levels, central bank commitment to easy monetary policy shows no signs of abating. The lack of inflation suggests these yields could remain anchored at low levels for some time.

China

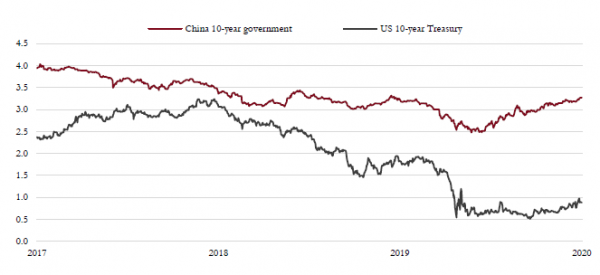

We’ve noted the relative strength of China’s economy and stock market as it continues to successfully handle the pandemic. Economic activity seems to have already recovered from Covid-19 and government monetary and fiscal stimulus should help further support the recovery following RMB1 trillion of deficit spending and RMB2.6 trillion of government bond issuance.

The government stimulus is typically skewed towards heavy industry and construction. which should help lift the rest of the economy. However, it’s clear that investors prefer the consumer and service areas rather than state-owned heavy industry and financials sectors.

Indicators of non-manufacturing sentiment have been in expansion territory for six months. Credit growth is accelerating for first time in years as the government continues to respond effectively to the Covid-19 pandemic, but there is a risk that government-mandated lending could lead to deteriorating balance sheet quality at Chinese banks.

US Election

Joe Biden is on track to become the 46th US President. The election was close and there’s been no ‘blue wave’ that many expected. Instead, the situation is more akin to a gridlock and is similar to the current political landscape, but with a new President in the White House.

While the prospects of a close race, legal challenge and Trump refusing to concede were high on our list of risks to the market, the reaction has in fact been the opposite. The market has embraced the prospect of a split Congress (with a Democrat House and Republican Senate), as it means that the more extreme policy measures of President-elect Biden will be significantly tempered. As a result, tax hikes and greater regulation on tech and financial companies now seem unlikely.

Fiscal stimulus expectations must also be revised lower as there is little chance that the Democrats will be able to push through their $3 trillion stimulus plan. However, it is likely that the deadlock will be broken soon and a stimulus plan in the region of $1 trillion to 1.5 trillion could be agreed. While less stimulus is a disappointment, it’s not sufficient to offset the positive reaction to a split Congress.

We expect plenty of noise from Trump and the Republican Party with regard to the legitimacy of the result but there seems to be a lack of evidence to suggest that the result can be overturned. Nevertheless, President Trump received the second most votes of any presidential candidate in history, so it would be premature to say his influence and populist political style is a thing of the past.