Market volatility continues unabated as equities rallied strongly in October following the worst September in 20 years. However, volatility has not been restricted to just equity markets, with fixed income once again failing to provide protection for investors as yields surged to new highs for the year. The repricing of UK gilts was notably savage, in part due to the muddled thinking and clumsy handling of the mini-budget although much of this has since unwound as the UK finds itself with its third Prime Minister this year.

What was the source of this market turbulence? The US Federal Reserve (Fed) went out of its way to quash any speculation that it might ease off on its policy of tightening monetary policy this year. Central banks around the world are keen to stress that inflation is their priority.

Despite data pointing to a weakening global economy, inflation remains a problem and has shown little meaningful momentum lower. Indeed, peak inflation is still to come for some regions and hopes for rapidly diminishing inflation pressures in H2 now look premature.

The volatility in equities and bonds brought both markets down to levels that may present good entry points over the long term, but for now we prefer the investment opportunities in fixed income. Equity markets have already rebounded somewhat but central bank policy remains unfriendly and corporate profits are coming under increasing scrutiny.

The economic background

Purchasing manager surveys have been in a downtrend all year as global economic momentum has ebbed. Manufacturing surveys now forecast contraction in many developed economies, particularly Europe where the ongoing energy crisis is pushing the region into recession.

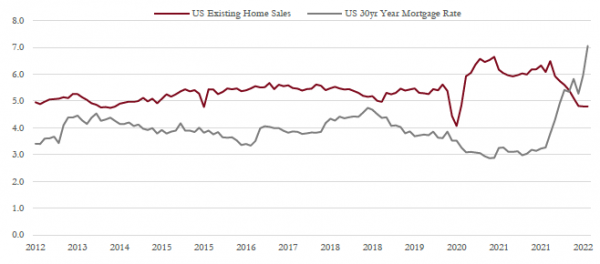

Rising rates are cooling the housing market – Central bank tightening is having the desired effect on the housing market. Mortgage rates in the US continue to rise and housing activity has dropped sharply as a result. The picture is similar in many other developed economies.

Source: Saranac Partners.

Housing markets across most developed economies are at the forefront of this slowdown. Spiralling mortgage rates are killing off demand and activity is collapsing, with US mortgage applications now at a 25-year low. As mortgage rates have more than doubled in the US, affordability measures have plummeted and are at their lowest levels since the sub-prime mortgage crisis in 2006.

Similar problems are being experienced in several other housing markets that have enjoyed strong price growth in recent years, including Canada, the UK, Sweden and Australia. Ultimately, this correction in property markets should feed through to lower inflation as prices and rents fall, but it’s a slow process and not something we expect to see until mid-2023.

Indeed, inflation remains stubbornly high across Western economies and has delivered mostly negative surprises. The data are uneven, with Europe in particular suffering from elevated energy prices, whereas headline inflation in the US is falling as a consequence of a sharp drop in commodity prices, including crude oil. Trends in core inflation have been less clear, US core inflation moved higher over the summer, which has been a key source of investor angst and concern about how far interest rates will rise. However, the most recent data has been more encouraging, particularly goods inflation which has shifted demonstrably lower.

It is not just inflation that has yet to respond to the tightening of financial conditions around the world – unemployment across major economies also remains at low levels. Consequently, the US service economy is a rare bright spot given the robust employment backdrop, and consumer bank balances still look healthy after the huge savings that were accumulated through the pandemic.

Conversely, any rebound in the Chinese economy has failed to materialise. Despite loosening fiscal and monetary policy, Chinese growth has been lacklustre as continued Covid lockdowns and a real estate sector still struggling with developer bankruptcies have sapped consumer confidence. Signs of an easing of the zero-Covid policy was eagerly anticipated at the Party Congress, however, Party leaders only reiterated the commitment to zero-Covid as President Xi consolidated his position as absolute leader.

Central banks

With a few notable exceptions such as China and Japan, central banks around the world have been acting in unison to tighten policy in the fight against inflation. Across nearly 40 central banks representing the main economies of both the developed and emerging markets, 90% are lifting interest rates at a rate that is unprecedented over the past 20 years.

The number of people actively looking for work remains low – Unemployment rates across major economies have fallen back to exceptionally low levels and the jobs market is showing no sign of distress as yet, despite the tightening of financial conditions.

Ironically, the strength of the US consumer may prove to be a hindrance rather than a help in the current environment. If the US consumer is less sensitive to interest rates now, supported by ample savings and a healthy jobs market, then the Fed may be forced into a stronger and longer tightening of monetary policy to achieve its aims.

Furthermore, recent comments from Fed chairman Jay Powell have made it clear that restoring price stability will “bring some pain” and require higher interest rates, slower growth, and “softer labour market conditions”. As the Fed tightens policy further, so the risk rises that it goes too far and engineers a full-blown recession rather than the desired ‘soft landing’.

Market attention is not only focused on inflation trends at the moment, but also on the US employment picture as investors look for any sign of a cooling in the jobs market, which might persuade the Fed to follow a less aggressive tightening cycle.

Unfortunately, over recent weeks, the inflation and employment data have shown no sign of such a cooling and the possibility of a Fed ‘pivot’ to a softer stance has diminished. Indeed, at the latest Fed meeting it warned of higher rates over a longer period of time, although the pace at which interest rates rise is likely to slow from here.

The investment environment

Equities

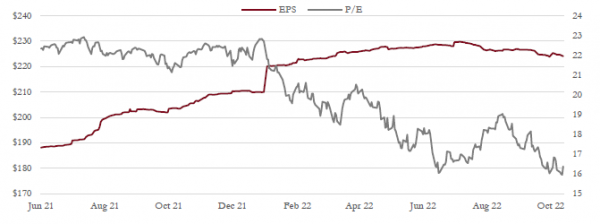

Equities remain in the thrall of the bear market with many major indices down 20% to 25% this year. Valuations have been responsible for nearly all of the correction in prices, and earnings have been remarkably resilient overall until recently.

There has been a sharp divergence within the market’s earnings. Energy stocks have seen strong positive revisions, which have masked a much more significant deterioration in other parts of the market, such as industrial and technology companies.

Further negative surprises to earnings forecasts seem likely, creating additional headwinds to equity markets in the near term. However, this adjustment is necessary in order to reset expectations at realistic levels.

Company profit forecasts have fallen – This chart shows the P/E and EPS for the S&P500. Earnings forecasts have started to roll over, but the downward revision has been small so far, in part due to the strength of the energy sector’s earnings this year. Valuations have corrected a long way.

Source: Saranac Partners.

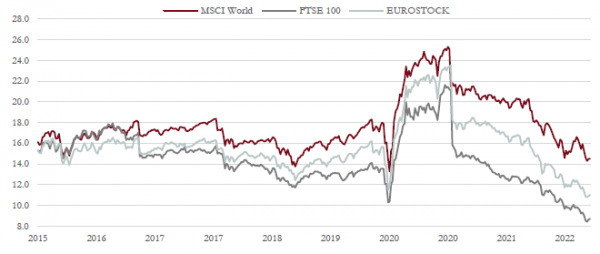

On a more positive note, valuations are now well below their long-term averages. In Europe and the UK, the valuation picture is outright cheap and is discounting much of the expected pain to come through this winter’s recession.

Our previous analysis of equity valuations suggested that index levels in September may have presented an opportunity to add to positions as absolute valuations were well below average. However, bond yields have also moved higher over that time and so the relative valuation of equities compared to bonds is looking less attractive than it has for some time.

Global growth has slowed further, central banks are committed to continued tightening of monetary policy and the outlook for corporate earnings is increasingly troubled. Given the mixed messages from the valuation standpoint, we are happy to wait before increasing our exposure to equity markets. In fact, having seen a sharp bounce in equities since mid-October our preference is to fade that rally.

Stock market valuations – Equity markets outside of the US look particularly cheap now.

Source: Saranac Partners.

Fixed income

September’s US economic data affirmed the need for policy tightening as August’s inflation readings were above expectations and the labour market remained firm. Following the hawkish comments from Fed chairman Powell at the Jackson Hole policy meeting in August, this strong data killed off any hopes that the Fed may pause in its efforts to tighten policy.

In addition, the September FOMC meeting introduced the new Fed guidance for the future path of interest rates – the so-called ‘dot-plot’. It was revised to show a

meaningful rise in the expected level of interest rates over the next six to nine months. Peak interest rates are now forecast to be 4.75% to 5.0%, which is well up from the previous expectation of 3.75%

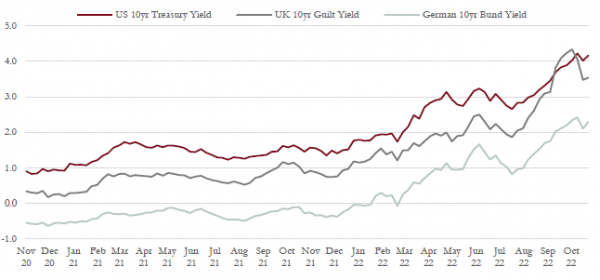

As a result, bond yields in the US rose 50 to 70 basis points across the curve and European bond markets followed suit. However, the UK gilt market suffered one of its worst months in memory as the Chancellor’s ‘mini-budget’ sparked an even greater sell-off in sterling fixed income, which saw 10-year gilt yields jump from 2.8% to over 4% by month end.

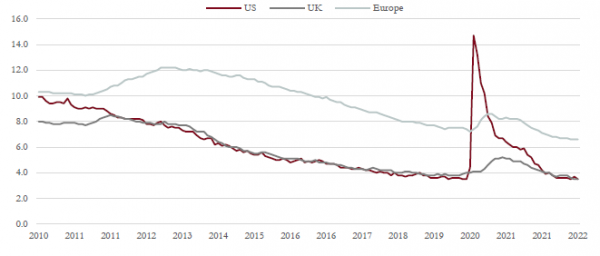

Government bond yields have increased sharply – Bond yields across all markets have risen dramatically in recent weeks, the move in UK gilts has been particularly severe but has now retraced some of that move.

Source: Saranac Partners.

Corporate bond markets were unable to escape the shift in sentiment as US investment grade credit spreads widened modestly but yields rose by nearly 1% to 5.75%. High-yield bonds fared worse as spreads widened by 40bp to 5.5% and yields rose by over 1 percentage points to 9.5%.

Yields have moderated a little in November following on from a helpful CPI print in the US, which was lower than expected, as well as a return to some sort of normality in UL politics and fiscal policy.

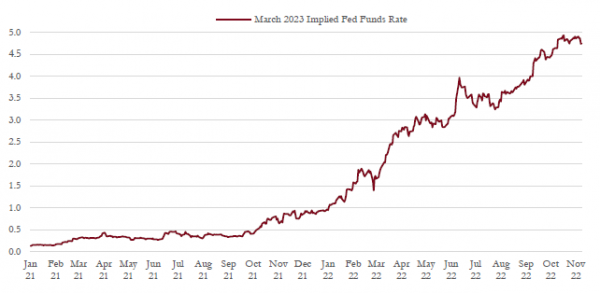

Nevertheless, for the first time this year the bond market and the Fed seem to be in broad agreement as to the direction of interest rates and how high they might go in order to bring inflation back under control. The forward curve for US interest rates is aligned with the Fed’s own ‘dot-plot’ in expecting rates to reach 4.75% in March next year but then remain as these levels until the end of the year by which time we may see the green shoots of the next easing cycle.

The consensus is for rates to continue to rise – Market expectations as to how high interest rates will rise over coming months have been consistently too low as inflation has surprised to the upside and the Federal Reserve has become much more hawkish. However, market forecasts and those of the Federal Reserve are now much more in alignment.

Source: Saranac Partners.

This development is encouraging and suggests the bond market is now discounting much of the policy tightening ahead. Furthermore, although near-term inflation remains stubbornly high, long-term expectations for inflation have been trending down since Q2 and now sit between 2.3% and 2.5% in the US. The market does not seem to be concerned in the long term about the inflation outlook.

Over recent months we have looked to US Treasury yields in excess of 4% as a chance to add to fixed income exposure and increase duration modestly. We still hold this view and so have been adding to bond positions.

Commodities

Most commodity prices have been falling sharply over the summer as recession concerns have undermined confidence in the demand picture looking ahead. Copper has fallen over 20% from its first-half highs, while even the oil price has retreated back from $120 in June to between $80 and $90 a barrel. However, OPEC’s recent announcement to cut production by 2 million barrels a day shows the cartel’s determination to support price’s at these levels.

These moves are certainly helpful in bringing down headline inflation levels. However, the natural gas crisis in Europe persists and although prices have moderated from the extremes in August, they remain eight to nine times higher than where they were in mid-2021. This situation is unlikely to change in the near term as gas supplies from Russia are certain to remain unreliable and it will take another two to three years to build the necessary LNG infrastructure to fully substitute Russian gas with LNG imports. Energy security in Europe is likely to remain challenged for some time.

The big move higher in bond yields and moderating long-term inflation expectations have seen real bond yields move into strongly positive territory. This development is negative for gold, as is the strength in the US dollar. On the flip side, geopolitical risk remains elevated and safe-haven assets are in demand. However, the overall investment environment for gold looks increasingly difficult, in particular now that US Treasuries offer yields in excess of 4%, and we are reducing exposure.

Currencies

The scale of the move higher in the US dollar rivals that of the move down in equity and bond markets. The trade-weighted US dollar has been this strong only once in the past 40 years, at the peak of the tech bubble in 2000–01.

Sterling has garnered much of the headlines given its precipitous fall this year to $1.10, which is partly a reaction to the recent mini-budget of tax giveaways and spending. However, sterling’s move against most other currencies, such as the euro and yen, has been far more modest as all currencies have weakened against the US dollar this year.

With a long-term view, many currencies look compellingly cheap, including sterling and the euro, whereas the US dollar looks overvalued. There is an overwhelming consensus to be overweight the US dollar but it is difficult to identify a catalyst in the coming months that might reverse the current trend.

Growth in Europe and the UK is clearly weaker than the US, interest rate differentials are wide and the disparity between the US and much of the rest of the world in terms of energy security is stark. As such, we are reluctant to make any big calls to switch into undervalued, beaten-up currencies just yet.