At our latest investment committee meeting, the discussion focused on the nature of the global economic cycle into and during 2022. The first part of 2021 was characterised by a surge in economic growth and corporate earnings, which supported a strong equity market rally.

More recently, there have been two major changes to this supportive environment. First, economic growth has slowed, notably in China, but also in the developed world. Second, there has been a marked acceleration in the pace of inflation.

High inflation poses a potential threat to the cycle and many asset prices for various reasons. It increases the potential for earlier interest rate rises than the market expects, squeezes real incomes, and might become more deeply embedded the longer the surge lasts.

Our analysis of the situation suggests the investment environment will remain moderately positive. However, conditions are less positive than they were at the start of 2021, and some downside tail risks are emerging.

Macroeconomic overview

The current situation remains quite bullish. Growth slowed sharply in Q3 but the latest economic data has surprised to the upside and the picture for Q4 is for a re-acceleration in growth. Some supply chain bottlenecks are showing signs that constraints are easing, semiconductor shortages are less extreme and shipping rates have started to fall.

The Q3 earnings season has shown that most companies have been adept in managing inflationary pressures so far. Profits have exceeded expectations and margins are reaching record highs. Revenue growth has allowed for operating leverage to continue and more than compensate for any cost pressures in the system. Earnings expectations continue to be revised higher into 2022, which is a positive sign.

With strong earnings, reaccelerating growth and early signs of bottlenecks easing, markets are set for a strong move higher since the correction in September. News of a Covid pill that could significantly reduce hospitalisations of those most seriously ill has also been a major boon for the market, in particular for those sectors most sensitive to the reopening of the economy.

Financial markets

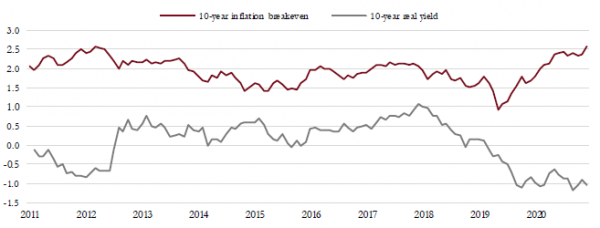

The relationship between inflation expectations and real yields seems to have broken down. Inflation expectations in many developed markets are at 10-year highs, yet real yields have fallen to record lows.

Nominal bond yields are lagging inflation expectations, and central bank policy is certainly a possible cause for this disconnect. Forward guidance is targeting a bond yield that is well below current inflation levels, which explains why real yields are so negative. We think that as central banks gradually reverse their extremely accommodative policies, nominal bond yields are likely to rise and real yields will become less negative.

Inflation and real yields (%) – Inflation expectations have moved to 10-year highs, yet real yields are at record lows as nominal bond yields have yet to respond to the inflation risk. Central bank intervention may have something to do with this. A tightening of monetary conditions may lift real yields.

In such an environment, we would expect to see a steepening of the yield curve as longer duration bond yields move higher faster than shorter duration yields. We are positioned for such an outcome in portfolios with our focus on credit risk and short duration.

In the event of higher yields and a steeper yield curve, we would expect cyclical and value-related stocks to perform well within equity markets. Very high-growth, high-valuation stocks could struggle given their sensitivity to long bond yields.

We have maintained a barbell strategy within our equity allocation for over a year now, balancing our core, high-quality growth stocks with exposure to more cyclical, and cheaper, stocks that we believe will benefit from economic reopening.

While our growth stocks trade at a valuation premium to the market, the premium is relatively small and we have no exposure to super-charged growth stocks with no earnings and extreme valuations.

A shift to increasing the proportion of cyclical stocks with a valuation discount would make sense in the environment we lay out here. Banks, logistics companies and industrial stocks are candidates for inclusion.

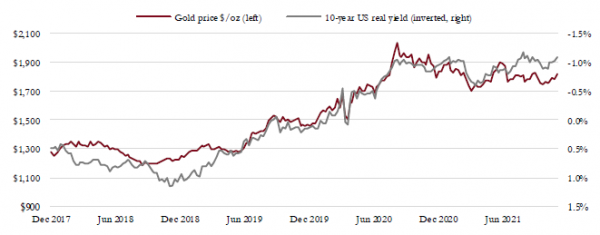

Gold has been a disappointing investment this year, its recent rally notwithstanding. The rise in inflation, higher inflation expectations and deeply negative real yields all failed to ignite a sustained rally

However, in current markets there are increasingly few portfolio diversifiers that protect us from the risks of much higher inflation and the volatility that would create, so we are maintaining the position for now.