During September, the multi-asset sterling moderate risk portfolio was broadly flat, leaving the portfolio return at -2% for the year.

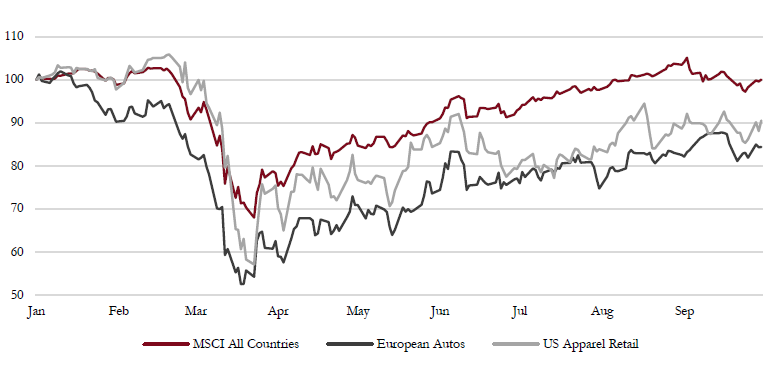

Equity markets experienced their first meaningful correction since June as the US, and to a lesser extent Europe, gave back some of the extraordinary gains of August.

This pullback relieved some of the more excessive sentiment and momentum indicators that had reached stretched levels by the end of August.

However, while equity positions were a negative contributor to performance during the month, our fixed income holdings benefited from a drop in government bond yields and generated positive returns to partially offset those equity losses.

Hedge funds, in general, had a positive month, as did emerging market equities, such that the end result was a month in which returns were broadly balanced.

Macro environment

Last month, we noted that the surge in equity prices, which at the global level occurred predominantly in the second quarter, had levelled off, as some key supports for risk assets had faded. The rebound in global growth has clearly moderated and in the US and Europe there are signs that this recovery is stalling out.

Covid-19 cases are increasing across much of the developed world and lockdown restrictions are tightening across wider areas of Europe as governments struggle to contain the acceleration in cases. These restrictions on movement and social activity will inevitably diminish economic growth in Q4. Indeed, we are already seeing the PMI surveys show manufacturing level off in key European countries, while the services sector has slipped back into contraction territory.

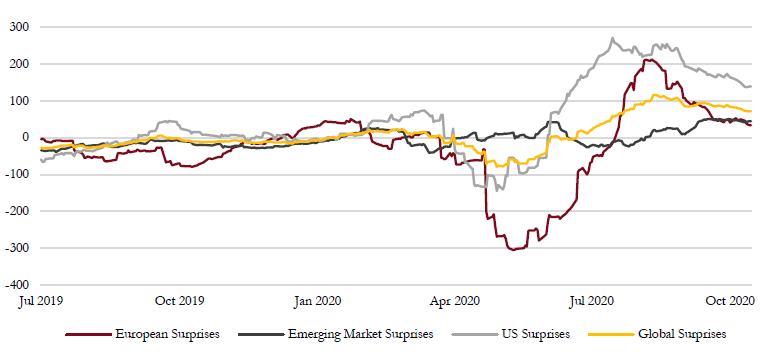

Furthermore, it is seems unlikely that the US administration and Congress will be able to agree an extension to the CARES Act and provide further stimulus to the hardest-hit areas of the US economy, a failure that raises the risk of Q4 economic growth reversing again. The Citigroup Economic Surprise index has enjoyed a remarkably strong run since May, but these positive surprises have faded away since August, in both the US and Europe.

Citigroup economic surprise index : After a very strong rebound in economic activity and positive surprises from May, US and European economic data has now rolled over and lost momentum.

Source: Saranac Partners.

At the same time, some event risks are coming into view: the US election may be less disruptive in the event of a Biden victory compared to a close call, but the latter risk has not dissipated. A protracted legal battle as to who has secured the most votes, both popular and in terms of the Electoral College, would be unsettling for markets.

Second, Brexit looms – deadlines continue to come and go and markets seem to be sanguine as to some kind of deal being signed, but time is running out.

However, to the upside the potential for better news on a vaccine over the next six months is improving and could prove an important catalyst for a broadening out of positive market sentiment.