Our view on markets is little changed this month as economic and market data has been consistent with recent trends. Our central view is that the economy has entered the late stages of the cycle.

Zeitgeist: the long-term context

We continue to believe the economy is in the late stages of the cycle – a period in which equity markets should modestly outperform other asset classes, but where the risks to the downside are as great as opportunities for upside. We believe that an environment of weak growth and further policy response (both monetary and fiscal) is the most likely scenario in the near term.

Macro drivers: medium-term environment

Macro momentum continues to slow and there a few signs of any response to monetary easing.

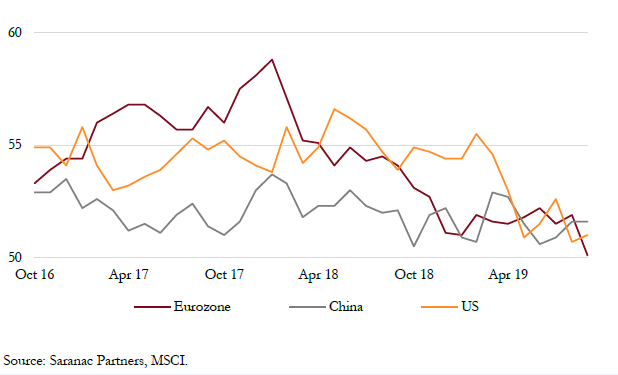

In particular, Europe continues to struggle with a weak manufacturing sector and there is little evidence of a recovery in growth in China. The US continues to outperform other regions but is also slowing.

However, while manufacturing activity remains weak there has been little evidence of spill-over into the broader economy. Non-manufacturing sectors, employment data and consumer spending continue to be more resilient.

Geopolitics remains a headwind for the global economy and the numerous political hotspots are capping potential upside to markets and constraining overall growth.

We see the resolution of geopolitical tensions, especially trade, as a possible catalyst for improved momentum in the economy and the equity market.

Taking the global economy’s pulse

The purchasing managers’ index (PMI) is an economic indicator derived from monthly surveys sent to supply chain managers within private companies across 19 industries. The results provide an insight into sales, employment, inventory and pricing. It is considered a leading indicator because it reacts to consumer demand and therefore gives an early indication of an economy’s health.

Signals: short-term indicators

We continue to be biased towards more positive market scenarios, which are consistent with indicators from our proprietary Global Growth Matrix. However, we do recognise that macro momentum is slowing and there is a reasonable risk of a market correction. Conversely, resolution of any of the pervading political issues may trigger an improvement in outlook.

In aggregate and as a broad indicator, our risk appetite lies between 3 and 4 on a scale from 1 to 10. Therefore, we are cautious on the near-term outlook, but not outright bearish.